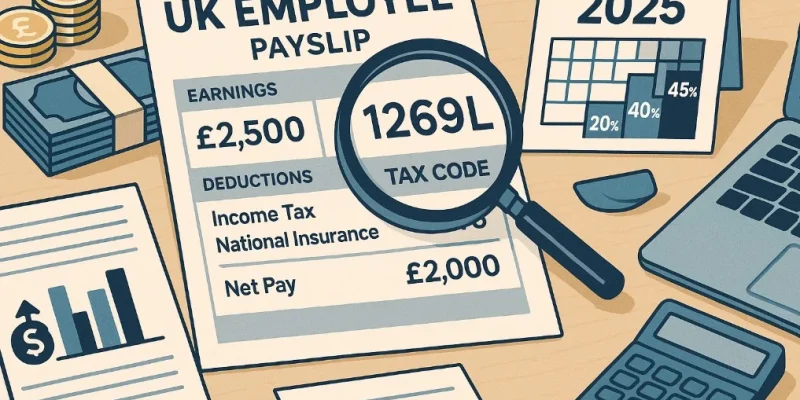

1269L Tax Code Explained: What It Means for Your Pay in 2025?

Understanding your tax code is essential for ensuring you’re paying the right amount of tax in the UK.

As of the 2025/26 tax year, the 1269L tax code has become the standard for many employees. But what does this code really mean, and how does it affect your take-home pay?

This guide will explain the 1269L tax code, how it’s applied, who it affects, and what to do if you think it’s wrong.

What Is The 1269L Tax Code And Why Does It Matter In 2025?

The 1269L tax code is assigned by HMRC and reflects the standard personal allowance for the 2025/26 tax year.

The number 1269 indicates that an individual is entitled to earn £12,690 tax-free before income tax is applied. The letter “L” signifies that the individual qualifies for the standard personal allowance.

This tax code is critical because it informs employers how much tax-free income an employee is entitled to, which directly affects payroll deductions.

Being on the correct tax code ensures accurate tax contributions and prevents both underpayments and overpayments.

For the 2025/26 tax year, the personal allowance has increased slightly from the previous year, making 1269L the new standard code for most employees.

How Does The 1269L Tax Code Affect Your Personal Allowance And Take-Home Pay?

The 1269L tax code provides a personal allowance of £12,690, meaning employees on this code will not pay income tax on that portion of their annual earnings. Once income exceeds this threshold, standard UK income tax bands apply.

Here is a table showing how income is taxed with the 1269L code:

| Income Range | Tax Rate | Tax Description |

| £0 – £12,690 | 0% | Tax-free personal allowance |

| £12,691 – £50,270 | 20% | Basic rate of tax |

| £50,271 – £125,140 | 40% | Higher rate of tax |

| Over £125,140 | 45% | Additional rate of tax |

Employees with the 1269L tax code can expect a slightly higher take-home pay in 2025 compared to the previous year due to the increase in the tax-free threshold.

The difference may seem small in weekly or monthly pay, but over a year, it provides modest savings.

Who Receives The 1269L Tax Code And How Is It Assigned?

The 1269L tax code is commonly issued by HMRC to individuals who are eligible for the standard personal allowance of £12,690 in the 2025/26 tax year.

It generally applies to people who are in straightforward tax situations, and its assignment ensures the correct amount of tax is deducted through the PAYE (Pay As You Earn) system.

Who Typically Receives the 1269L Tax Code?

Most UK taxpayers with regular employment will be issued this code. The following groups are the most likely to receive the 1269L tax code:

- Employees with a single job and no other taxable income

- Individuals who do not receive company benefits like a car or medical insurance that affect taxable income

- People without unpaid taxes or historical adjustments from previous tax years

- Those not receiving state benefits or pensions that reduce the personal allowance

The 1269L code is considered the “default” or standard code for the majority of UK workers. It ensures that individuals benefit from the tax-free allowance before income tax is deducted.

How Is the 1269L Tax Code Assigned?

HMRC uses a combination of employer-submitted data and personal tax records to assign tax codes. The process is largely automated but is influenced by:

- Information from your employer: When you start a job, your employer submits starter details to HMRC via the PAYE system.

- Your P45 or P46 form: These documents contain information about your income and tax paid to date. Submitting the correct form ensures that HMRC calculates the right tax code from the start.

- Self-assessment returns: For those who complete tax returns, HMRC may adjust your code based on additional income or deductions reported.

- Marriage allowance transfers: If you or your spouse claim the marriage allowance, your tax code will be altered to reflect the transfer.

- Benefits in kind: If you receive non-cash benefits through your job, such as a company vehicle, HMRC adjusts your personal allowance to reflect the taxable value of those benefits.

HMRC communicates your tax code via a Tax Coding Notice (form P2), usually sent out before the start of the new tax year.

You can also view your current tax code and its breakdown by logging into your Personal Tax Account on the HMRC website.

Temporary Codes and Adjustments

Sometimes, HMRC will issue a temporary tax code such as 1269L W1/M1. This is often used when:

- An individual starts a new job mid-year without a recent P45

- HMRC is awaiting further details from the employer

- The taxpayer’s records are not yet complete

In such cases, the tax-free allowance is applied on a weekly (W1) or monthly (M1) basis rather than across the entire year.

Once HMRC receives all the necessary data, it typically updates the code to the standard cumulative version.

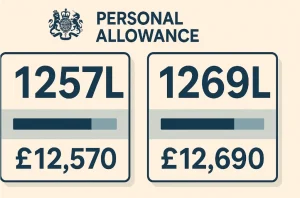

What Are The Differences Between 1269L And 1257L Tax Codes?

The 1269L and 1257L tax codes are both considered standard tax codes for their respective tax years, but they differ due to changes in the personal allowance threshold set by the UK Government.

Key Difference: The Personal Allowance Amount

| Tax Code | Tax Year | Personal Allowance | Annual Increase | Impact on Income Tax |

| 1257L | 2024/25 | £12,570 | – | Baseline tax-free earnings |

| 1269L | 2025/26 | £12,690 | +£120 | Additional tax-free income |

The increase of £120 in the personal allowance is reflected in the 1269L code. This means individuals on this code can earn slightly more before paying income tax.

For most taxpayers, this equates to a modest increase in take-home pay, usually between £20 and £50 per year, depending on overall earnings and tax brackets.

Implications for Employees

- Higher Net Pay: The change provides a small boost in earnings, as a larger portion of income is now tax-free.

- No Action Required: HMRC typically updates tax codes automatically, so most employees will not need to take any action.

- Pay Comparisons: Individuals comparing payslips between 2024 and 2025 may notice a slightly lower PAYE tax deduction, reflecting the raised allowance.

Other Differences to Note

- Coding Notice Updates: Those moving from 1257L to 1269L should receive a new coding notice from HMRC, typically issued before April 2025.

- Software and Payroll Adjustments: Employers are responsible for updating payroll systems to reflect the new tax code from the start of the tax year. Most modern systems do this automatically using HMRC’s real-time information (RTI) updates.

- Potential for Confusion: Some individuals may notice their code has changed and be unsure why. It’s important to understand that this is a routine annual update, not an indication of a problem with your tax.

Who Might Still Be On 1257L in 2025?

In some situations, an individual might still see 1257L on their payslip in the early part of the 2025/26 tax year. This can occur if:

- Their employer has not yet processed the HMRC update

- They are on a temporary or emergency tax code

- There has been a delay in PAYE submission or system synchronisation

If this happens, it is advisable to contact the employer or check the current tax code through the HMRC Personal Tax Account.

Can The 1269L Tax Code Be Incorrect Or Need Updating?

It is not uncommon for individuals to be placed on an incorrect tax code. Mistakes can occur due to:

- Incomplete or incorrect employment records

- Starting a new job without a P45

- Receiving untaxed income not reported to HMRC

- Failing to update HMRC about changes in income or benefits

If the wrong code is applied, employees may pay too much or too little tax. Overpayments are generally refunded, but underpayments may result in a bill later in the year.

Reviewing payslips and HMRC notices regularly is recommended. A discrepancy in net pay or tax deductions may signal a code issue.

What Should You Do If Your 1269L Tax Code Seems Wrong?

If there’s any suspicion that the 1269L tax code applied is incorrect, action should be taken promptly. Here are steps to resolve it:

- Access the Personal Tax Account on HMRC’s website to view and update tax code information

- Contact HMRC directly by phone or via online services

- Notify your employer so they can confirm the details reported to HMRC

- Provide missing documents, such as a P45, when starting a new job

Correcting your tax code ensures accurate deductions going forward and prevents the accumulation of unpaid tax.

How Does The 1269L Tax Code Impact Self-Employed Or Multiple Jobholders?

The 1269L tax code primarily applies to salaried employees under the PAYE system, but individuals with more than one job or mixed income sources may also receive it under certain conditions.

In cases where someone has two or more jobs:

- HMRC assigns the full personal allowance (via 1269L) to the primary source of income

- A second job may be taxed at the basic rate using a BR code or another adjusted code

- Self-employed individuals who also have part-time employment may still receive the 1269L code for their employment income

Multiple income streams can lead to complex tax scenarios. It’s important to confirm that allowances are not duplicated, which could result in underpaid tax.

What Are The Latest HMRC Updates About Tax Codes In 2025?

For the 2025/26 tax year, HMRC has implemented a small increase to the personal allowance, raising it from £12,570 to £12,690. As a result, 1269L is now the standard tax code for eligible employees.

Other key updates from HMRC include:

- Continued development of the Personal Tax Account system to improve self-service access

- Automated tax code updates for eligible individuals with changing income

- Increased use of real-time PAYE submissions to improve accuracy and reduce delays

Employers are expected to stay compliant with real-time information (RTI) reporting, which allows HMRC to update tax codes promptly based on payroll data.

How Can You Avoid Being Put On The Wrong Tax Code?

While mistakes in tax codes can happen, there are a few measures individuals can take to reduce the risk:

- Always submit a P45 or P46 when changing jobs

- Regularly check your payslip and tax code notices

- Inform HMRC about any change in personal circumstances, such as marriage or additional income

- Set up and monitor your Personal Tax Account to track changes and corrections

In cases where an emergency code is issued, such as 1269L W1/M1, it often means your employer is using temporary information. Once full details are received, HMRC will issue an updated tax code.

Conclusion

The 1269L tax code may seem like a small detail, but it plays a significant role in how much tax you pay and how much income you keep.

With the new tax year underway, ensuring you’re on the right code can prevent financial surprises and maximise your take-home pay.

Understanding your tax code empowers you to manage your finances confidently and communicate effectively with HMRC or your employer if something seems off.

Frequently Asked Questions

What does the 1269L tax code mean on my payslip?

It means you’re entitled to a personal allowance of £12,690 for the tax year before income tax applies to your earnings.

Is 1269L the correct tax code for 2025?

Yes, for most employees with no additional income or benefits, 1269L is the standard code for the 2025/26 tax year.

Why has my tax code changed from 1257L to 1269L?

The personal allowance increased in 2025, which changed the standard tax code from 1257L to 1269L.

Can I pay too much tax on the 1269L code?

If your code is incorrect or you’re on multiple incomes, you might overpay. Check your payslip or tax account to ensure accuracy.

How do I update my tax code with HMRC?

You can update your tax details via your Personal Tax Account online or by contacting HMRC directly by phone.

Will my tax code affect my pension contributions?

Indirectly. While the code affects how much tax is taken, it doesn’t directly change pension contributions, which are calculated separately.

Does 1269L apply to people with two jobs?

It can apply to your main job. HMRC will issue a separate tax code for your second job based on your income situation.