Tax Code 1257LM1 Explained: What It Means for Your Pay in 2025?

Understanding your tax code is essential to managing your finances accurately, especially when unexpected changes affect your pay.

The 1257LM1 tax code often raises questions for UK employees, as it can lead to higher tax deductions due to its temporary, non-cumulative nature.

Whether you’ve started a new job or changed employers in 2025, this guide explains what 1257LM1 means, how it differs from standard codes like 1257L, and what steps you can take to correct it.

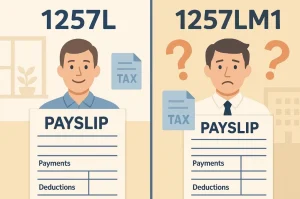

What is Tax Code 1257LM1 and How is it Different from 1257L?

The 1257L M1 tax code is a temporary code used by HMRC when they do not have complete information about your income for the current tax year.

While it still includes the standard personal allowance of £12,570, it is applied on a non-cumulative basis, meaning your allowance is split monthly and not calculated based on your total income for the year.

This contrasts with the standard 1257L code, which is cumulative and calculates your tax liability based on your total earnings since the start of the tax year.

The “M1” indicates that it is applied on a Month 1 basis, which treats each month as if it is the first month of the tax year, ignoring any previous pay or tax paid.

In essence, 1257LM1 functions as an emergency tax code and is often a temporary measure until HMRC receives accurate income details from your employer or from you directly.

Many people who change jobs or start new employment without submitting a P45 are assigned this tax code.

Why Might You Be Assigned the 1257LM1 Tax Code?

HMRC may issue the 1257LM1 tax code for various administrative or transitional reasons, usually when you start a new job or your employment circumstances change and HMRC has not yet received your full income details.

Here are some typical situations that could result in being placed on this code:

- Starting a new job without giving your new employer your P45

- Transitioning from self-employment to PAYE employment

- Having more than one job at the same time

- Incorrect or incomplete starter form submitted by your employer

When any of these apply, HMRC does not yet know how much of your personal allowance you’ve already used, so they apply the 1257L M1 tax code to ensure you’re taxed safely without underpayment.

How Does the 1257LM1 Tax Code Affect Your Take-Home Pay?

One of the key impacts of being on the 1257LM1 tax code is the potential for overpayment of tax in the short term.

Because the allowance is split monthly and does not reflect cumulative earnings, the system cannot adjust for months where you had no income or lower earnings. This can reduce your take-home pay, especially if you begin work later in the tax year.

For example, if you start working in August, a cumulative tax code would calculate your personal allowance from April to August, giving you a larger tax-free amount upfront.

The 1257LM1 code, however, would only provide 1/12th of the personal allowance each month, potentially resulting in more tax paid in the early months.

What is the Difference Between Cumulative and Non-Cumulative Tax Codes?

A cumulative tax code (like 1257L) considers your total earnings and the amount of tax you have already paid since the beginning of the tax year.

It spreads the personal allowance evenly across the year but also adjusts your tax payments over time to correct any underpayments or overpayments.

In contrast, a non-cumulative tax code such as 1257LM1 applies your personal allowance only to the income earned in the current pay period.

It does not factor in prior earnings or previously paid tax, which often results in more tax being deducted, especially if you’ve only recently started working in that tax year.

Below is a comparison table outlining the key differences:

| Feature | Cumulative Tax Code (1257L) | Non-Cumulative Tax Code (1257LM1) |

| Considers year-to-date earnings | Yes | No |

| Suitable for new starters | With a P45 | Without a P45 |

| Adjusts for overpaid tax | Automatically over time | Requires manual refund or end-of-year reconciliation |

| Typically permanent | Yes | No |

This difference explains why employees with the 1257LM1 tax code often find their net pay to be unexpectedly low until the correct code is applied.

How Can You Check if Your Tax Code is Correct in 2025?

You can verify your current tax code in a few straightforward ways. The most direct method is by checking your payslip, which typically displays the tax code next to your name or NI number.

Another option is to log into your personal tax account on the HMRC website. This platform allows you to view your tax code, update employment details, and see whether HMRC has issued any new coding notices.

If you’ve received a P2 Coding Notice in the post or electronically, it will also indicate the tax code HMRC has assigned for the current tax year.

If you’re unsure about why a particular code has been issued, it’s always advisable to get in touch with HMRC or your employer’s payroll department for clarification.

What Should You Do if You’re on the Wrong Tax Code Like 1257LM1?

If you believe your tax code is incorrect, acting promptly can help prevent unnecessary overpayment. The first step is to contact HMRC and explain your situation.

You may need to provide employment details such as your employer’s PAYE reference number and your salary.

If your employer submitted an incomplete or incorrect starter checklist, you should ask them to send a corrected version to HMRC.

This will help trigger a new calculation and, in most cases, a new coding notice will be sent to your employer with the correct tax code, usually 1257L if you’re entitled to the standard personal allowance.

It’s worth noting that if you’re on the 1257LM1 tax code temporarily, any overpaid tax will typically be refunded either through payroll once the code is corrected or at the end of the tax year through the P800 reconciliation process.

How Will Tax Code Changes in 2025 Impact UK Workers?

The 2025/26 tax year begins on 6 April 2025. As of now, the personal allowance remains frozen at £12,570 due to previous fiscal policy decisions aimed at stabilising the economy.

This means the standard tax code, 1257L, also remains unchanged unless the government introduces new changes in the autumn or spring budget.

If changes are made to the income tax thresholds or personal allowance, HMRC may issue new tax codes accordingly.

Workers should keep an eye on official government announcements, as such changes could affect take-home pay or shift more individuals into higher tax bands if allowances are not increased in line with inflation.

Understanding how these changes affect tax codes will help employees better anticipate their monthly net income and plan ahead financially.

Can You Get a Tax Refund If You Were on the 1257LM1 Code?

Employees who have been on the 1257LM1 tax code may be entitled to a tax refund once their tax code is corrected or the tax year ends.

Since the non-cumulative nature of the M1 code often results in overpayment, HMRC reconciles the tax paid with actual earnings at the end of the year. This process is typically automated.

You will receive a P800 tax calculation letter if HMRC identifies that you’ve overpaid. If you’re due a refund, you can claim it online via your personal tax account, and payment is usually made by bank transfer within a few days.

If your tax code is corrected mid-year, your employer may adjust the tax you pay in subsequent months to offset any overpayments made earlier in the year.

How is Tax Code 1257LM1 Shown on Your Payslip and What Do the Letters Mean?

On your payslip, the tax code typically appears near your personal information or earnings summary. The code 1257LM1 can be broken down as follows:

- 1257 refers to your personal allowance of £12,570 (the last digit is dropped)

- L indicates you are entitled to the standard tax-free allowance

- M1 signifies that the code is being used on a Month 1 basis

This code is generally displayed under sections like “Tax Code” or “PAYE Code” on your payslip.

It’s crucial to understand this code as it directly impacts how your tax is calculated and how much you take home each month.

Employers are required to use the tax code provided by HMRC and cannot change it unless they receive an updated instruction.

If your tax code seems incorrect, the best course of action is to notify HMRC rather than relying on your employer to fix it.

How Do You Change Your Tax Code from 1257LM1 to 1257L?

If you’ve received a 1257LM1 code but believe you should be on 1257L, the first step is to ensure that HMRC has the correct information about your employment. You can do this by:

- Logging into your HMRC personal tax account and checking or updating your employment status

- Contacting HMRC by phone or webchat to confirm your income details

- Ensuring your employer has submitted a complete starter checklist or a valid P45

Once HMRC has all the necessary information, they will issue a new tax coding notice (P6) to your employer. This updated code will usually be reflected in your next payslip, and any overpaid tax may be refunded automatically.

The time it takes for the correction to show in your pay depends on your employer’s payroll schedule and how quickly the updated code is processed.

Below is a summary table showing how the update process works:

| Step | Action Required |

| Identify the incorrect tax code | Check your payslip or HMRC personal account |

| Notify HMRC | Call or log in to update employment details |

| Employer updates HMRC forms | Submit P45 or corrected starter checklist |

| HMRC sends new code to the employer | Usually within 1–2 weeks |

| Refund or adjustment | Via payroll or end-of-year reconciliation |

Being proactive helps ensure your tax code reflects your correct circumstances, preventing both overpayment and underpayment of income tax.

Conclusion

The 1257LM1 tax code is commonly assigned in situations where HMRC lacks complete employment details, often resulting in higher temporary tax deductions.

While it includes the standard personal allowance, its Month 1 basis limits its accuracy.

If you’re on this code, checking your HMRC tax account and acting quickly to update your details can help ensure you receive the correct code. Understanding how 1257LM1 works empowers you to take control of your take-home pay in 2025.

FAQs About Tax Code 1257LM1

What does the “M1” in 1257LM1 actually stand for?

The “M1” stands for Month 1, meaning the tax code is being used on a non-cumulative basis. Each month is treated independently.

Is 1257LM1 a bad tax code to have?

Not necessarily, but it can result in overpaid tax if left uncorrected. It’s meant to be temporary until HMRC confirms your tax details.

How long does it take HMRC to update a tax code?

Usually within 1 to 2 weeks after receiving updated information from your employer or directly from you.

Can being on 1257LM1 affect my Universal Credit?

It may indirectly impact Universal Credit if your net income is reduced due to higher tax. Always report changes in take-home pay to DWP.

Do I need to contact HMRC or will my employer fix the tax code?

Employers can’t change tax codes on their own. HMRC must issue the new code after reviewing your situation.

Will I automatically get a refund if I was overtaxed on 1257LM1?

Yes, if you’re due a refund, HMRC will issue a P800 after the tax year ends, or adjust it in your next pay cycle once the correct code is applied.

Can I be on 1257LM1 and have more than one job?

Yes, but you should ensure only one job uses your personal allowance (1257L or 1257LM1), and the others are taxed using a BR or 0T code.