S1257L Tax Code | What It Means and How It Affects Your Pay?

Understanding your tax code is vital to ensuring you’re paying the correct amount of income tax.

For many employees and pensioners in Scotland, the S1257L tax code is the standard tax code issued by HMRC. But what does it mean, and how does it affect your earnings?

This guide will break down the S1257L tax code, explain how it’s calculated, why it might change, and what to do if it appears incorrect.

What Does The S1257L Tax Code Mean In The UK?

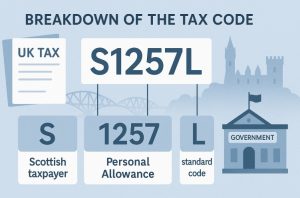

The S1257L tax code is used for individuals living in Scotland who qualify for the standard Personal Allowance. It is issued by HMRC and is made up of three parts:

- The letter ‘S’ indicates that the person is a Scottish taxpayer, meaning their income is subject to Scottish Income Tax bands rather than those used in England, Wales, or Northern Ireland.

- The number ‘1257’ represents the standard tax-free Personal Allowance amount of £12,570 for the current tax year. This figure is typically reviewed annually and adjusted in line with inflation or government policy.

- The ‘L’ suffix indicates eligibility for the standard Personal Allowance. This is the most common suffix and suggests that the individual is not subject to any special tax circumstances such as age-related relief or restrictions due to benefits.

This code allows HMRC to instruct employers and pension providers to deduct tax based on the individual’s tax-free allowance and income level using Scottish tax brackets.

How Does The S1257L Tax Code Affect Your Take-Home Pay?

The S1257L tax code plays a crucial role in determining how much of your salary remains after tax deductions.

It directly impacts your net income by defining your tax-free allowance and the tax bands that apply to your earnings in Scotland.

Understanding The Personal Allowance

At the heart of the S1257L tax code is the Personal Allowance, which is currently set at £12,570.

This means you do not pay any income tax on the first £12,570 you earn within the tax year. The allowance is automatically factored into your PAYE deductions when this code is used.

If your tax code doesn’t reflect the full allowance (for example, if it’s incorrect or an emergency code is applied), your take-home pay may be lower than expected.

Conversely, having the full S1257L code ensures you’re receiving the maximum available tax-free benefit.

How Scottish Income Tax Bands Apply?

Unlike the rest of the UK, Scotland uses a different set of income tax bands. Once your earnings exceed the £12,570 allowance, tax is applied based on these brackets:

| Income Range | Scottish Tax Band | Tax Rate |

| £12,571 – £14,732 | Starter Rate | 19% |

| £14,733 – £25,688 | Basic Rate | 20% |

| £25,689 – £43,662 | Intermediate Rate | 21% |

| £43,663 – £75,000 | Higher Rate | 42% |

| Over £75,000 | Top Rate | 47% |

Each portion of income is taxed progressively. For instance, if you earn £30,000 annually:

- The first £12,570 is tax-free

- The next £2,162 is taxed at 19%

- Income between £14,733 and £25,688 is taxed at 20%

- The remaining income from £25,689 to £30,000 is taxed at 21%

This graduated structure ensures fair taxation but also means that small increases in income can move portions of your salary into higher bands.

Example of Monthly Impact

Let’s take a closer look at how this affects a Scottish employee’s monthly income:

| Annual Salary | Monthly Gross Pay | Estimated Monthly Tax | Estimated Take-Home Pay |

| £25,000 | £2,083 | £160 | £1,923 |

| £35,000 | £2,916 | £310 | £2,606 |

| £50,000 | £4,166 | £610 | £3,556 |

Figures are approximate and depend on National Insurance and other deductions.

When Deductions May Be Higher?

Even with the correct S1257L tax code, your deductions may increase if:

- You are on a non-cumulative code like S1257L W1 or M1

- You receive taxable employment benefits

- You have multiple sources of income

- HMRC has adjusted your code to collect underpaid tax from a previous year

It’s always advisable to check your payslips and compare them against expected tax amounts using the GOV.UK tax calculator or your Personal Tax Account.

Who Gets The S1257L Tax Code And Why?

The S1257L tax code is not arbitrarily assigned. It reflects both your geographical tax status and personal eligibility for the standard allowance.

Knowing why and how this code is issued can help avoid errors in taxation.

Residents of Scotland

The most important eligibility requirement for the S1257L tax code is residency in Scotland. HMRC determines this based on where your main residence is located.

If you spend most of your time living in Scotland, even if working across the UK, you are classified as a Scottish taxpayer.

Employers report your address details to HMRC, and this influences the tax prefix. If you move to Scotland or away from it, it’s essential to notify HMRC so that your tax code can be updated.

Employment and PAYE Workers

If you are employed and pay tax through the Pay As You Earn (PAYE) system, and your only source of income is a salary, you are highly likely to receive the S1257L tax code if you live in Scotland. This setup reflects standard circumstances, where:

- No additional tax adjustments are needed

- You have no untaxed income to declare

- You are not claiming tax reliefs that change your code

The tax code is used by your employer to calculate how much income tax to deduct from your wages each month.

Pensioners and Retirement Income

Retirees who receive income through private pensions may also be issued the S1257L code, provided they reside in Scotland and their pension is their only taxable income.

The Personal Allowance remains the same, and deductions are made according to the Scottish tax brackets.

Those With No Complex Tax Needs

The S1257L code is typically issued in straightforward tax situations. It may not be used if:

- You claim specific tax reliefs (e.g. marriage allowance)

- You have taxable benefits like a company car

- You have untaxed income from freelance work, investments, or overseas assets

In such cases, HMRC will adjust your tax code accordingly to reflect the estimated tax liability across your sources of income.

First-Time Employees or Job Starters

For new employees in Scotland, especially those without a P45 from a previous job, the S1257L tax code may be applied as a temporary measure.

In some cases, it might be issued as an emergency code (e.g. S1257L W1/M1), which does not consider year-to-date income.

Once your employer provides full starter information, HMRC reviews your details and updates the tax code to the cumulative version of S1257L.

Self-Assessment Filers

Those who complete a Self Assessment tax return are also eligible to receive the S1257L code on any employment or pension income, as long as their primary tax liability is already covered via PAYE.

Any additional tax due is calculated through the return and paid separately.

In such cases, the S1257L code still applies to the regular income portion, while the individual reports other income types (e.g. rental, dividends) through Self Assessment.

What Is The Difference Between Tax Codes S1257L And 1257L?

Although both codes include the same tax-free allowance, the difference lies in the income tax rates applied. The presence of the ‘S’ in S1257L is significant.

| Feature | S1257L (Scotland) | 1257L (Rest of UK) |

| Region | Scotland | England, Wales, NI |

| Tax Bands | Scottish Income Tax Bands | UK Income Tax Bands |

| Personal Allowance | £12,570 | £12,570 |

| Tax Rate Differences | More tax bands with lower thresholds | Fewer bands with higher thresholds |

Scottish Income Tax includes additional bands such as the starter rate, intermediate rate, and advanced rate.

These allow for a more graduated taxation scale, which can mean slightly higher or lower deductions depending on earnings.

1257L is commonly issued to residents of England, Wales, and Northern Ireland. If someone with a 1257L code moves to Scotland, it is necessary to update HMRC to switch to the S1257L code for correct regional taxation.

Can Your S1257L Tax Code Change During The Year?

Yes, HMRC may update your tax code in response to changing personal circumstances or new income information. Several scenarios could lead to a change:

- Taking on an additional job or income stream

- Receiving company benefits such as a car or accommodation

- Shifting between employment and pension income

- Adjustments in estimated earnings or tax overpayment from a prior year

When a change is necessary, HMRC will issue a revised tax code and send a Notice of Coding. This letter outlines why the change occurred and what the new code will be.

Employers and pension providers receive this update electronically, allowing for near-instant implementation of the revised tax deductions.

What If Your S1257L Tax Code Is Wrong?

Errors in your tax code can occur if HMRC has outdated information or if your income details have changed without notification. A wrong code could result in paying too much or too little tax.

To identify and fix any issues, individuals should:

- Log in to their Personal Tax Account on the official GOV.UK website

- Review the income and benefits HMRC has recorded for the current tax year

- Use the tax code checker tool to understand what the code means

- Report inaccuracies to HMRC through the online system or by phone

In some cases, HMRC may automatically issue a corrected code after receiving updated data from your employer. If tax has been overpaid, you may be entitled to a refund. If underpaid, the shortfall is usually collected in future tax periods.

How Is The S1257L Tax Code Handled In Self Assessment?

For individuals who file a Self Assessment tax return, it is essential to correctly declare Scottish taxpayer status. This ensures your return is processed under the appropriate Scottish tax regime.

During the online filing process:

- You will be asked whether you live in Scotland

- You must tick the appropriate box to confirm Scottish residency

- The tax calculation will apply the Scottish Income Tax bands based on this information

Failure to correctly indicate your tax residency can result in miscalculated liability. This may trigger delays or the need to amend your return.

If your main source of income is from employment or pension and is taxed through PAYE using the S1257L code, you may still need to file a Self Assessment return if you have other income, such as dividends, property, or foreign income.

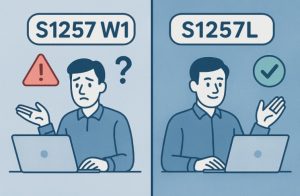

Are Emergency Tax Codes Different From S1257L?

Emergency tax codes are temporary codes issued when HMRC lacks complete information about your income or employment. While they may look similar to the S1257L code, they function differently.

Some emergency tax codes include:

- S1257L W1 (Week 1)

- S1257L M1 (Month 1)

- S1257X

These codes apply tax to your income per pay period rather than cumulatively. This often results in higher tax deductions in the short term.

Once your employer submits full employment details to HMRC and your income history is verified, your code will typically be updated to the standard S1257L.

Emergency codes are most often seen in the following situations:

- Starting your first job

- Changing jobs without providing a P45

- Receiving income from multiple employers simultaneously

It’s important to monitor your payslips and resolve emergency coding as soon as possible to avoid unnecessary tax deductions.

How Can You Check And Understand Your Income Tax?

To ensure your tax deductions are correct, use official online tools provided by HMRC. These resources allow you to:

- View how much income tax you have paid so far in the tax year

- Check your current tax code

- Estimate how much tax you will pay based on projected earnings

You can also download or view your tax documents, such as your P60 or P45, and confirm your taxable income as reported by your employer.

Logging into your Personal Tax Account provides a central dashboard where you can manage your income, review previous returns, and update your contact details. You can also use it to report changes in circumstances that could affect your tax code.

Conclusion

The S1257L tax code ensures that Scottish taxpayers receive the correct tax-free allowance and are taxed according to local rates.

Understanding this code is crucial to managing your finances and ensuring your salary reflects accurate deductions.

Mistakes or confusion around tax codes can lead to underpayments, overpayments, or unexpected tax bills.

Staying informed about what your code means and when it might change can help you take control of your income and tax obligations.

FAQs About the S1257L Tax Code

What does the ‘S’ in S1257L stand for?

The ‘S’ denotes that the individual is a Scottish taxpayer, and thus subject to Scottish Income Tax bands rather than the rest of the UK’s tax structure.

Why do I have the S1257L tax code if I just started a job?

If HMRC receives full employment details from your new employer and you reside in Scotland, you will likely receive the S1257L code by default.

How do I change an incorrect tax code?

You can use your Personal Tax Account on GOV.UK or contact HMRC directly to request a correction if your code doesn’t reflect your situation accurately.

Do students and part-time workers also get the S1257L code?

Yes, as long as they are based in Scotland and eligible for the standard personal allowance, they are assigned the S1257L code.

Can I pay too much tax under the S1257L code?

Yes. Overpayments can happen if your income or employment details aren’t accurate. You can reclaim the excess by contacting HMRC or through Self Assessment.

What’s the difference between S1257L and BR tax code?

The BR code taxes all income at the basic rate without any personal allowance, whereas S1257L includes the tax-free £12,570 allowance for Scottish residents.

When will I know if my tax code changes?

HMRC typically sends out a coding notice (P2) when your tax code is updated, especially after employment or benefit changes.