Table of Contents

ToggleWhen you’re starting a business, it’s important to have the right infrastructure in place. That means not only having the necessary equipment and supplies, but also having the financial resources to get your business off the ground. One of the essential resources for any business is a bank account. But which bank is best for business?

In this blog post, we will explore 10 of the best banks in the UK for businesses of all sizes. Each bank has something special to offer, from small businesses to big corporations. So whether you’re a startup or an established business, read on to find out which bank is right for you.

What are the Different Types of Bank Accounts?

There are many bank accounts, but the most common are business and current accounts. A business account is a bank account used by businesses to manage their finances. It usually has high-interest rates and flexible terms that allow companies to pay their bills and make other financial transactions. A current account is a bank account that mainly allows people to store their money. It usually has low-interest rates but also offers some benefits, such as access to loans and credit cards.

What is a Business Account?

A business account is a bank account specifically set up for businesses. This means that the bank will offer specific banking features and services specifically designed for businesses, such as special deposit and withdrawal limits, faster processing times, and more robust security measures.

Some of the key benefits of having a business account include,

- The ability to easily access funds when you need them.

- The ability to easily track your finances and stay on top of your spending.

- The ability to receive customized services and support tailored to your business needs.

- The opportunity to get discounts on banking products and services.

If you’re thinking about opening a business account, be sure to explore all of your options. Many banks offer great business accounts, so it’s important to find one that’s right for your needs.

Types of Business Accounts

There are many different types of business accounts available from banks, and it can be hard to decide which is the best for your needs. Here are three of the most common types of business accounts and their pros and cons:

1. Open a Current Account

A current account is the most basic type of business account. With a current account, you can easily access your money whenever you need it, and there’s no need to worry about minimum deposits or monthly fees. However, a current account isn’t ideal if you plan on doing a lot of online banking – most banks don’t offer good online banking services with current accounts.

2. Open a Business Account with a Specialist Bank

If you want better online banking features and more flexibility than a current account offers, consider opening a business account with a specialist bank. These banks usually offer better customer service and more comprehensive banking services, including net banking, emergency loans, and credit cards. However, as with all specialist banks, you’ll likely pay higher fees than you would at a mainstream bank.

3. Use an e-Banking Service Instead of Opening an Actual Bank Account

If you don’t plan on using your business account for anything other than online transactions (or if you’re not comfortable using traditional bank services), consider using an e-banking service instead.

These services offer similar features to traditional bank accounts. Still, without the high costs associated with opening an actual bank account – most e-banking services offer free account establishment and no monthly fees. Each business account has its advantages and disadvantages, so choosing the right one for your needs is important.

How to Choose a Bank for Business Account Business Account?

One of the most important factors when choosing a bank for a business account is the availability of facilities and services offered. From online banking to telephone banking, there are many options available to businesses.

When choosing a bank, it is important to consider the following,

- The bank’s location and customer service. It is beneficial if the bank has branches across the UK so that customers can easily access their accounts and speak to staff.

- The bank’s lending policies and rates. Comparing different banks’ interest rates and loan terms is important before settling on one.

- The bank’s online platform and mobile app functionality. This will allow you to manage your finances from anywhere with an internet connection.

- The bank’s customer support team. It is helpful if the team can offer advice on finance, business growth, or other related issues.

- The bank’s security features. Look for a bank with features such as 24/7 customer support, online banking with two-factor authentication, and malware protection.

- The bank’s investment options. Some banks offer business account holders access to their investment products, such as stockbroking and fund management.

- The bank’s commitment to sustainability. Consider a bank that promotes environmental and social responsibility.

Which Type of Account is Right for You?

The best type of business account depends on your specific needs and preferences. If you’re primarily looking for an easy way to access your money, a current account may be your best option. A specialist bank may be a better choice if you want more comprehensive banking features. And finally, if you don’t plan on using your business account for anything other than online transactions, e-banking services may be your best option.

Which Bank is Best for Business Account? – Top 10 Banks in UK

When it comes to choosing the best bank for businesses in the UK, there are a number of factors to consider. Here are four of the best banks for businesses,

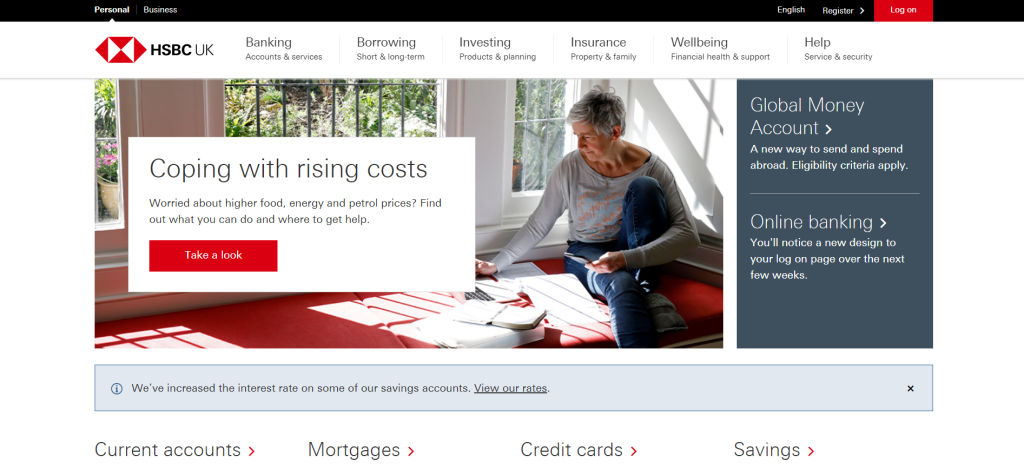

1. HSBC

HSBC is one of the largest and most well-known banks in the world, and its business account offerings are no exception. HSBC offers a wide range of products and services to small businesses, including investment products, lending, and banking solutions.

Its mobile app is also highly user-friendly, making it easy to manage your finances on the go.

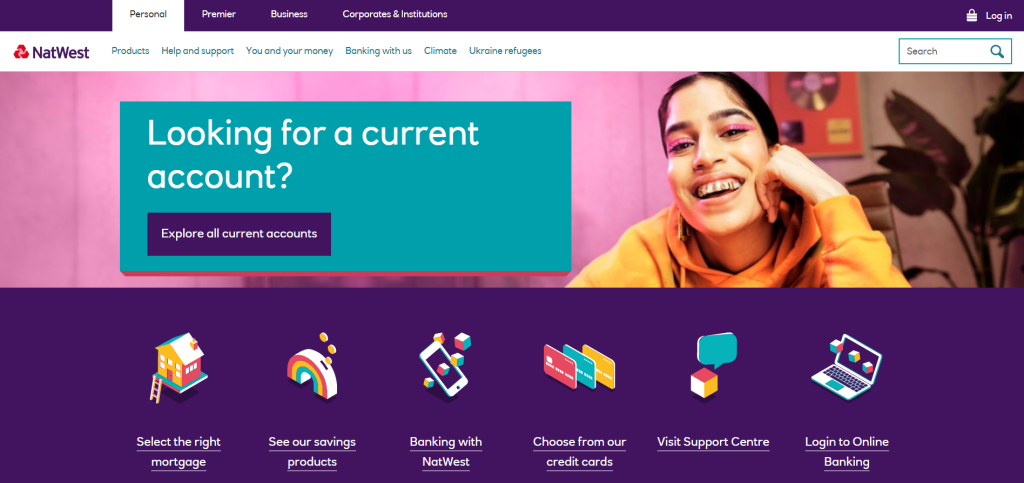

2. NatWest

Natwest is another large bank with a strong presence in Britain’s business market. Like HSBC, Natwest offers a wide range of products and services to small businesses, including investment products, lending, and banking solutions.

It also has a strong mobile app that makes managing your finances easier than ever.

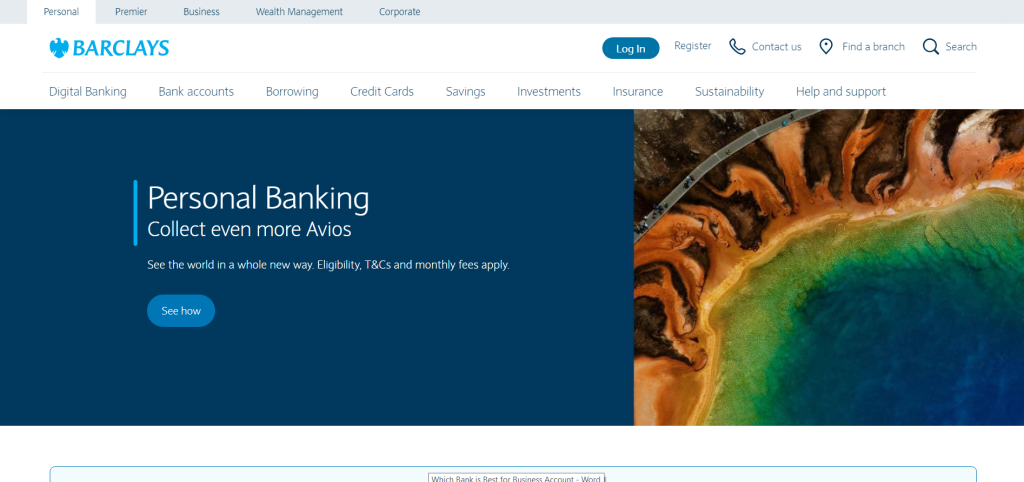

3. Barclays Bank plc (Barclays)

Barclays is one of the biggest banks in Europe and has been known for its high-quality customer service for years. That same customer service extends to its business customers too which is one of the best banks for small businesses in the UK.

That said, Barclays does charge slightly more than some of its competitors for certain services; but overall it remains a top choice for many businesses.

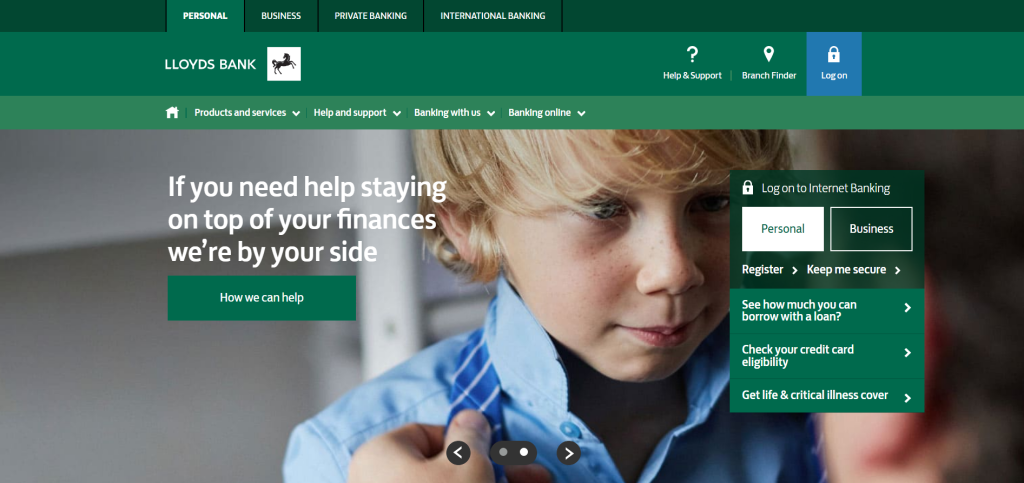

4. Lloyds Bank

Lloyds Bank is another large bank with a strong presence in Britain’s business market. Like Barclays and Natwest, Lloyds offers a wide range of products and services to small businesses, including investment products, lending, and banking solutions.

It also has a strong mobile app that makes managing your finances easier than ever.

5. The Co-operative Bank

The Co-operative Bank is one of the UK’s oldest banks, and it has a long history of providing quality customer service to small businesses. That said, The Co-operative does charge slightly more than some of its competitors for certain services.

But overall it remains a top choice for many businesses.

6. Virgin Money plc (Virgin Money)

Virgin Money is one of the newest banks in the UK and focuses exclusively on small businesses. That said, Virgin Money offers an extensive range of products and services to small businesses, including investment products, lending, and banking solutions.

Its mobile app is also highly user-friendly, making it easy to manage your finances on the go.

7. Ulster Bank plc (Ulster Bank)

Ulster Bank is a smaller bank that focuses exclusively on small businesses. That said, Ulster Bank offers an extensive range of products and services to small businesses, including investment products, lending, and banking solutions.

Its mobile app is also highly user-friendly, making it easy to manage your finances on the go.

8. British Business Bank

The British Business Bank is a financial institution that provides business loans and credit cards to UK businesses. The bank was founded in 1948 and has over £2 billion in assets.

The bank offers a variety of loan products, including short and long term loans, overdrafts, and business credit cards. The bank also offers a range of support services, including advice on banking products and services, business finance training, and business advice.

9. The Bank of Scotland

The Bank of Scotland is another smaller bank that focuses exclusively on small businesses. That said, The Bank of Scotland offers an extensive range of products and services to small businesses, including investment products, lending, and banking solutions.

Its mobile app is also highly user-friendly, making it easy to manage your finances on the go.

10. The Royal Bank of Scotland

The Royal Bank of Scotland is the last bank on this list and, as its name suggests, is primarily focused on small businesses. The Royal Bank of Scotland offers an extensive range of products and services to small businesses, including investment products, lending, and banking solutions.

Its mobile app is also highly user-friendly, making it easy to manage your finances on the go.

Conclusion

Choosing the right bank for your business is important, and not just because you’ll need a loan or two to get started. Researching which banks offer the best customer service, convenient online banking features, and low interest rates can make all the difference when it comes to succeeding in business. So which banks made our list of the top 10 banks in UK? Read on to find out!

Which Bank is Best for Business Account? – FAQs

What is the minimum opening deposit for a business account?

The minimum opening deposit for most banks is £500, although there are some exceptions. The best way to find out is to call your bank and ask.

What is the minimum opening balance for a business bank account?

The minimum opening balance for most banks is £1,000.

How many accounts can I open with a single bank?

Most banks allow up to six business accounts per individual customer. However, some banks may have more generous limits.

Can I use a bank account for personal expenses as well?

Yes, you can use your bank account for both personal and business expenses. However, you may have to pay interest on any personal expenses that are charged to your account.

Can I close my business bank account if I no longer need it?

Yes, you can close your business bank account at any time. However, you will have to pay any outstanding fees and balances that are still owed.

Do I need a business bank account to start a business?

No, you do not need a business bank account to start a business. You can open a bank account without any prior experience or formal training.

What kind of insurance is offered by my bank?

Most banks offer varying levels of insurance coverage, including theft protection and liability insurance.

Can I use my bank account to pay for my business expenses?

Yes, you can use your bank account to pay for your business expenses. However, you may have to pay interest on any personal expenses that are charged to your account.

Do I need to pay any fees when opening a business account?

There may be certain fees associated with opening or maintaining a business account with a particular bank. It’s important to research these fees before making a decision. The minimum opening deposit for a business account with a UK bank is typically £500. However, this may vary depending on the bank and the account type. Some banks require less money up front while others require more. It’s always best to speak with a banker at your chosen bank to get an idea of what’s required for an account of your desired type.

What is your reaction?

Categories

Latest Posts