VAT Notice 741A: When and Where VAT Applies to Cross-Border Services?

Determining the correct place of supply for services is a crucial aspect of UK VAT legislation, especially for businesses engaged in cross-border transactions.

VAT Notice 741A issued by HMRC provides detailed guidance on how to apply VAT to services that cross international borders.

This guide breaks down the key sections of the notice to help businesses understand how and when VAT applies when dealing with overseas customers or suppliers.

What Is VAT Notice 741A And Why Is It Important For International Service Providers?

VAT Notice 741A is a technical document issued by HMRC that provides guidance to businesses on determining the place of supply for services.

This notice becomes particularly relevant for businesses involved in cross-border transactions where services are supplied or received across UK borders.

Businesses that should read this notice include:

- UK-based suppliers of services to customers located overseas

- UK-based businesses receiving services from non-UK suppliers

- Non-UK businesses that provide services to UK customers

The notice enables these businesses to determine where VAT applies and under what circumstances VAT should or should not be charged. Understanding these rules is key to correct VAT accounting and compliance.

What Factors Determine The Place Of Supply And How Does It Affect VAT For UK And Overseas Businesses?

Understanding the place of supply is critical for applying the correct VAT treatment to services, particularly when dealing with international transactions.

HMRC’s VAT Notice 741A sets out clear rules that help determine where a service is considered to be supplied and whether it is liable to UK VAT.

Defining The Place Of Supply For VAT Purposes

The place of supply is the location where a service is treated as being delivered for VAT purposes.

This designation is important because it determines which country’s VAT rules apply. If the place of supply is in the UK, the service is subject to UK VAT.

If it is outside the UK, whether in an EU member state or a third country then the supply is considered outside the scope of UK VAT.

Services supplied outside the UK are not liable to UK VAT, but this does not necessarily mean no VAT is due.

Instead, VAT obligations may shift to the jurisdiction where the service is consumed, and local tax rules may apply.

Implications For UK-Based Suppliers

UK businesses need to establish whether the place of supply of their services is within or outside the UK.

If the service is supplied in the UK, they are required to charge UK VAT and report it to HMRC, regardless of where the customer is located.

However, if the place of supply is outside the UK, UK VAT should not be charged. The supplier must maintain sufficient evidence to demonstrate that the supply falls outside the UK’s VAT scope.

This includes contracts, correspondence, and customer details that confirm the recipient’s location.

It is also important to assess whether the customer is liable for VAT in their own country.

In many cases, especially in B2B transactions, the reverse charge mechanism will apply, requiring the customer to account for VAT locally.

Importance Of Identifying What Is Being Supplied

The nature of the service being provided directly affects the applicable place of supply rule.

There are general rules for most services, but specific services such as digital, cultural, or educational services are subject to special treatment.

To avoid misinterpretation, invoices should clearly describe the type of service provided. Avoid vague terms like “consulting” or “professional service” without detail.

Instead, specify whether it was legal advice, IT support, or training delivery, for example. Clear identification ensures that the correct VAT rule is applied.

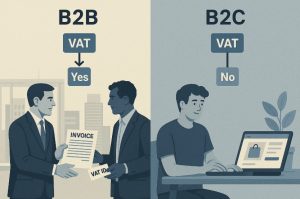

Identifying The Type Of Customer Receiving The Service

There are two main categories of recipients: business customers (B2B) and non-business consumers (B2C). VAT treatment varies significantly depending on the category.

B2C customers include:

- Private individuals

- Government departments

- Charities without business activities

- Any customer receiving the service solely for private use

B2B customers are:

- Corporate entities

- Public bodies engaged in economic activity

- Mixed-use customers (e.g., charities or public sector bodies with business operations)

In cases where the customer provides a valid VAT number, they can generally be treated as a business. If such information is not available, the supplier may need to make a reasonable assessment based on how the customer intends to use the service.

Understanding UK Territorial Scope For VAT

The territorial extent of the UK for VAT purposes includes:

- England

- Scotland

- Wales

- Northern Ireland

- The Isle of Man

However, it does not include:

- The Channel Islands

- Gibraltar

These excluded territories fall outside the scope of UK VAT, and suppliers should not treat them as part of the UK for VAT purposes. The Isle of Man is treated as part of the UK under Manx legislation, which largely mirrors UK law.

The Northern Ireland Protocol, which addresses trade between Northern Ireland and the EU, applies only to goods. Services are not impacted by the protocol and are covered solely under UK VAT legislation.

VAT Obligations For Non-UK Businesses Supplying UK Customers

Non-UK businesses that supply services into the UK may be required to register for VAT in the UK. There is no registration threshold for non-established businesses.

If a non-UK business provides services with a UK place of supply and these services are not subject to the reverse charge, they must register for VAT and account for UK VAT accordingly.

If all the services supplied to UK customers fall under the reverse charge mechanism, the business is not eligible to register for UK VAT. These rules are detailed further in VAT Notice 700/1.

Conditions For Input Tax Recovery

UK VAT law allows businesses to reclaim VAT on costs related to taxable supplies. In the context of international services, input tax recovery is also allowed for:

- Supplies made outside the UK that would be taxable if made within the UK

- Certain exempt services (known as specified supplies) such as financial or insurance services, when provided to non-UK customers

Input tax recovery in such cases is subject to the partial exemption rules detailed in VAT Notice 706. Businesses must keep accurate records and allocate VAT correctly across their various activities to support any claim.

Which Legal Provisions Form The Basis Of VAT Notice 741A?

The guidance within VAT Notice 741A is based on key provisions of the VAT Act 1994. These include:

- Section 7A, which outlines the general rule for B2B and B2C services and defines a relevant business person

- Section 8, which covers the accounting procedure for services received from outside the UK (reverse charge mechanism)

- Section 9, which determines where a person is regarded as belonging for VAT purposes

- Schedule 4A, which includes special rules for specified types of services

- Schedule 6 Paragraph 8, related to the valuation of services under reverse charge

- Schedule 8 Group 7, which details the zero rating of certain international services

These legislative references provide the foundation for determining when and how VAT should be applied to international service transactions.

How Is The VAT Liability Determined For Cross-Border Services?

Once the place of supply has been identified, VAT liability must be assessed. If the place of supply is outside the UK, then the supply is generally not subject to UK VAT. If the place of supply is within the UK, the business must determine the applicable VAT rate.

Services may be:

- Standard-rated at 20 percent

- Zero-rated

- Exempt from VAT

- Subject to a reduced rate (e.g., 5 percent in some cases)

Unlike the export of goods, there is no blanket VAT relief for services supplied internationally. Each service must be individually assessed. HMRC also advises consulting VAT Notice 700 for broader guidance on VAT liability and conditions.

How Does The Reverse Charge Mechanism Work For Overseas Suppliers?

The reverse charge mechanism shifts the responsibility for VAT reporting from the supplier to the customer. It applies when a UK VAT-registered business receives certain services from a provider located outside the UK.

In practice, the UK business:

- Accounts for both output tax and input tax on the same VAT return

- Often results in a net-zero effect if the business is fully VAT recoverable

This mechanism is not optional. If the conditions apply, the UK business must account for VAT as if it had supplied the service itself.

The reverse charge helps to prevent VAT loss by ensuring that services imported from abroad are subject to the same treatment as those bought from UK providers.

What Are The Rules For Determining Where A Business Belongs For VAT?

To apply the correct VAT treatment, it’s essential to establish where the business belongs. This affects whether VAT is chargeable and where the place of supply is considered to be.

A business is considered to belong where it has:

- A business establishment, such as its main office

- If not, then a fixed establishment involved in the service supply

- If neither, then its usual place of residence

The correct assessment is important when the business operates in more than one country, and the location most directly connected to the supply of the service will determine the place of supply.

Which Services Qualify For Zero Rating Under VAT Notice 741A?

Certain services may be zero-rated when supplied to non-UK customers, provided they meet specific conditions. These include services that are used or enjoyed outside the UK or are connected to the export of goods.

Examples of zero-rated services include:

- Intermediary services related to overseas transactions

- Work on goods for export

- Training services provided to overseas governments

The following table outlines some services and their VAT rating based on VAT Notice 741A:

| Type of Service | Customer Location | VAT Treatment |

| Legal services to overseas client | Outside UK | Outside scope |

| Intermediary services | Outside UK | Often zero-rated |

| Repairs on goods for export | Outside UK | Zero-rated |

| Training to overseas government | Outside UK | Zero-rated |

| B2C digital services to EU consumer | EU Member State | Local VAT applies |

Clear documentation is required to prove eligibility for zero rating. This can include contracts, proof of export, and evidence of the customer’s overseas status.

How Should Businesses Use VAT Notice 741A Effectively?

VAT Notice 741A is designed to be a comprehensive reference but not all parts apply to every business. It is structured so that businesses can focus only on the sections relevant to their specific circumstances.

Best practices for using the notice effectively include:

- Reviewing the list of contents to find applicable sections

- Understanding the definitions and rules before applying them

- Referencing other notices such as VAT Notice 700 for broader principles

HMRC expects businesses using this notice to already have a working knowledge of VAT. For new or complex cross-border services, businesses may need to consult a VAT advisor or accountant.

When Are B2B And B2C Services Treated Differently Under VAT Rules?

The distinction between B2B and B2C services determines the place of supply and hence the VAT treatment.

For B2B services, the supply is typically treated as occurring where the customer belongs. For B2C services, it is usually where the supplier belongs.

There are exceptions, especially for:

- Electronically supplied services

- Telecommunications

- Broadcasting services

- Cultural, artistic, or sporting activities

The following table outlines the general rule:

| Type of Supply | Place of Supply Rule | VAT Implication |

| B2B | Where the customer belongs | May fall outside UK VAT |

| B2C | Where the supplier belongs | Likely subject to UK VAT |

| B2C Digital | Where the customer resides | Local VAT due via OSS |

Misclassifying a transaction can lead to incorrect VAT treatment, so determining whether the customer is in business or not is essential.

What Are The Common Examples And Exceptions Outlined In The Notice?

VAT Notice 741A provides several illustrative examples to help businesses understand how the rules apply in real-world scenarios. While these are helpful, HMRC cautions that they are not exhaustive.

Examples include:

- A UK-based consultancy firm providing services to a business in the USA. Since it’s a B2B supply and the customer is outside the UK, no UK VAT is charged.

- A UK business receiving accounting services from a provider in France. The UK business must apply the reverse charge.

- A UK business delivering online training to a private customer in Spain. The VAT must be accounted for in Spain, often via the One Stop Shop (OSS) scheme.

Understanding exceptions and reading the full context within the notice is important, especially for sectors that fall under special rules or for services involving both goods and services.

Frequently Asked Questions About VAT Notice 741A

What is the difference between exempt and zero-rated services?

Exempt services are not subject to VAT and do not allow VAT recovery on related costs, whereas zero-rated services are taxable at 0%, and businesses can reclaim input VAT.

Do I charge VAT if I provide services to a business customer in the EU?

In most B2B cases, the place of supply is the customer’s location, so UK VAT is not charged, but the customer may have to apply a reverse charge in their own country.

Are digital services treated differently under VAT Notice 741A?

Yes. Digital services have special rules, especially for B2C customers, and may require VAT registration in the consumer’s country through schemes like One Stop Shop (OSS).

Can I use VAT Notice 741A to determine VAT for goods?

No, VAT Notice 741A only applies to services. For goods, you should consult VAT Notice 702 and other related guidance on importing and exporting.

What evidence do I need for zero rating services?

Businesses should retain contracts, proof of customer location, and communications that verify the conditions for zero rating are met.

Is the reverse charge applicable to non-business customers?

No. The reverse charge typically only applies to B2B transactions. B2C services may require the overseas supplier to register for UK VAT, depending on the service.

How often is VAT Notice 741A updated?

The notice is updated periodically by HMRC. Businesses should refer to the official GOV.UK page to ensure they are using the most current version.