Inheritance Tax When Second Parent Dies: How Much Will You Pay?

Inheritance tax becomes a critical consideration when the second parent passes away, potentially reducing the value of the estate passed on to beneficiaries.

In the UK, understanding how the nil-rate band, spousal exemptions, and residence nil-rate band work is essential for effective estate planning.

This guide explains what changes after the second death, how much tax may be payable, and the steps families can take to mitigate liability and protect the financial legacy for future generations.

How Does Inheritance Tax Work When the Second Parent Dies?

In the UK, inheritance tax (IHT) is a charge on the estate of someone who has died. The estate includes all the deceased’s property, possessions and money.

The threshold for inheritance tax, known as the nil-rate band, is currently set at £325,000 for an individual. Any portion of the estate that exceeds this threshold is taxed at a standard rate of 40 percent.

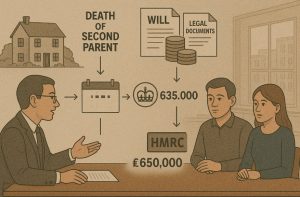

When the second parent dies, the full estate is assessed for inheritance tax because the spousal exemption that applies when the first parent dies no longer exists.

The estate is subject to tax on any value above the nil-rate band unless specific reliefs or allowances apply.

Inheritance tax must be paid within six months of the person’s death. If the payment is delayed, interest is added by HMRC.

Some or all of the tax can be paid in instalments, particularly for property or land, but most liquid assets must be settled in a lump sum.

What Changes When the Second Parent Passes Away?

The most notable change is that the estate is now transferred to the next generation or to other non-exempt beneficiaries. This transfer typically triggers the inheritance tax calculation.

With the spousal exemption no longer available, the entire value of the estate is considered, unless the estate benefits from other allowances.

Families often find that the largest inheritance tax bill comes after the second parent dies.

The children or other beneficiaries are now responsible for paying the tax, and in many cases, this can lead to the need to sell assets to meet the liability.

Assets most commonly affected include:

- Property, especially the family home

- Savings and investments

- Pensions and life insurance not written in trust

If the estate planning was not structured to consider the eventual death of the second parent, there may be limited opportunities to mitigate the tax burden.

Can the Nil-Rate Band Be Transferred Between Spouses?

When the first parent passes away and leaves their entire estate to their spouse or civil partner, the nil-rate band is unused because of the spousal exemption. This unused allowance can be transferred to the surviving partner and applied upon their death, increasing the threshold for inheritance tax.

This creates a combined allowance of £650,000 that can be used against the estate on the second death. The transfer must be claimed by the executor or administrator of the estate when the second parent passes away.

Example Calculation:

| Scenario | Nil-Rate Band | Transferable NRB | Total Tax-Free Threshold |

| First death: everything passed to spouse | £325,000 | £325,000 | £650,000 |

| Second death: full estate assessed | £325,000 | £325,000 | £650,000 |

The transfer of the nil-rate band can significantly reduce the inheritance tax liability, especially when combined with other reliefs.

What Is the Residence Nil-Rate Band (RNRB) and How Does It Apply?

Introduced in April 2017, the Residence Nil-Rate Band (RNRB) is an additional allowance for individuals who pass their main residence to direct descendants, including children, grandchildren, and stepchildren. The RNRB is currently set at £175,000 per person.

When both the standard nil-rate band and the RNRB are combined, an individual can pass on up to £500,000 tax-free. For a married couple or civil partners, this total doubles to £1 million, provided both nil-rate bands and RNRBs are available.

To qualify for the RNRB:

- The property must have been the deceased’s main residence

- It must be passed to direct descendants

- The value of the estate must be below £2 million. Beyond this point, the RNRB is tapered and eventually withdrawn

Threshold Comparison Table:

| Individual or Couple | NRB | RNRB | Total Allowance |

| Single person | £325,000 | £175,000 | £500,000 |

| Married couple (combined) | £650,000 | £350,000 | £1,000,000 |

This combined threshold provides an opportunity for families to minimise or entirely eliminate their inheritance tax liability if assets are passed to children or grandchildren.

How Are Beneficiaries Affected by the Second Death Tax Charge?

The second death in a family often results in the estate passing to children or other heirs. Without careful estate planning, this transition can create substantial financial consequences. Beneficiaries might inherit less than expected due to the tax deduction.

In some cases, the inheritance tax liability may require the sale of family property, investments or even business assets to satisfy HMRC’s demands. This is particularly burdensome when the estate comprises illiquid assets like property or art.

Common effects on beneficiaries include:

- Reduction in the total value inherited

- Immediate financial responsibility to settle inheritance tax

- Delays in receiving their inheritance due to probate processes

The impact can be softened through pre-planned tax mitigation strategies and timely legal guidance.

Often, the involvement of a financial advisor at the time of the first parent’s death can help prevent excessive liability when the second parent passes.

How Much Inheritance Tax Will You Pay When the Second Parent Dies?

The amount of inheritance tax due is calculated by subtracting the applicable nil-rate band and residence nil-rate band from the estate’s total value. The remaining taxable portion is then charged at 40 percent.

Example Scenario:

- Total estate value: £750,000

- Combined NRB (both parents): £650,000

- Taxable portion: £100,000

- Inheritance Tax Due: 40% of £100,000 = £40,000

This example illustrates how a moderately sized estate can incur a significant tax bill without planning. With the addition of the RNRB, the taxable portion could be eliminated entirely if the estate qualifies.

Allowances that help reduce inheritance tax include:

- Charitable donations (reduce taxable estate)

- Gifts made seven years prior to death

- Assets held in certain types of trusts

- Pensions not forming part of the estate

Accurate record keeping and regular review of estate value and beneficiaries are essential to managing liability and ensuring assets are distributed as intended.

What Strategies Help Reduce Inheritance Tax After the Second Death?

Inheritance tax can significantly reduce the value of an estate passed on to children or other beneficiaries, especially after the second parent dies and the estate transitions to the next generation.

However, with careful planning and legal structuring, the overall tax liability can be substantially reduced or even avoided in some cases.

Various strategies are available to manage and minimise inheritance tax. These methods not only preserve family wealth but also ensure that beneficiaries receive the intended value from the estate.

Each strategy must be applied within the rules set by HMRC and ideally under the guidance of legal or financial professionals.

1. Making a Valid and Up-to-Date Will

A Will is one of the most important estate planning tools. Without a Will, an estate is distributed under the rules of intestacy, which may not align with the deceased’s wishes and can lead to unnecessary tax liabilities.

A carefully drafted Will can:

- Specify tax-efficient distribution of assets

- Direct gifts to charities, which are exempt from inheritance tax

- Establish trusts to manage how and when beneficiaries receive their inheritance

For example, a couple may use their Wills to set up discretionary trusts that hold a portion of the estate outside of the surviving partner’s taxable estate, ultimately reducing tax on the second death.

2. Gifting During Lifetime

One of the most common ways to reduce inheritance tax is to give away parts of the estate during one’s lifetime.

Gifts to individuals are generally tax-free if the person making the gift survives for seven years after giving it. This is known as the seven-year rule.

Key points regarding gifting:

- Gifts made more than seven years before death are completely free from inheritance tax

- Gifts made within three to seven years may qualify for taper relief, which reduces the tax rate

- Gifts of up to £3,000 per year (annual exemption) are tax-free and do not count towards the seven-year rule

- Small gifts of up to £250 per person per tax year are also exempt

If used strategically, lifetime gifting can remove substantial value from the taxable estate and ensure that assets reach intended recipients sooner.

3. Establishing Trusts

Trusts can play a vital role in inheritance tax planning, particularly for high-value estates or families with complex needs. By placing certain assets into a trust, the asset may no longer be counted as part of the taxable estate.

Types of trusts commonly used include:

- Discretionary Trusts: Allow trustees to control how and when beneficiaries receive funds

- Bare Trusts; Pass assets directly to named beneficiaries, often used for children

- Interest in Possession Trusts: Provide income to a named beneficiary for life, with the capital passed on after their death

While trusts are subject to their own tax rules and reporting requirements, they can offer long-term protection of assets and potential inheritance tax savings when structured appropriately.

4. Using Life Insurance Policies Written in Trust

A life insurance policy can provide immediate funds to cover an inheritance tax bill. When written in trust, the payout from the policy does not form part of the deceased’s estate and is therefore free from inheritance tax.

Benefits of life insurance in trust include:

- Quick access to funds for beneficiaries, often faster than estate distribution

- No impact on the taxable estate’s value

- Flexibility to cover projected IHT bills

This strategy is especially helpful for families with illiquid assets, such as property, who do not want to sell inherited assets to settle the tax.

5. Leaving a Legacy to Charity

Charitable donations are exempt from inheritance tax. If 10 percent or more of the net estate is left to charity, the inheritance tax rate on the remainder of the estate drops from 40 percent to 36 percent.

This strategy not only benefits good causes but also reduces the overall tax bill. For instance, if a £1 million estate donates £100,000 to charity, the remaining £900,000 is taxed at 36 percent instead of 40 percent.

Charity legacies can be included in a Will or made through lifetime giving.

6. Making Use of Business and Agricultural Relief

For those who own businesses or agricultural land, Business Relief (BR) and Agricultural Relief (AR) can significantly reduce or eliminate inheritance tax on qualifying assets.

- Business Relief may reduce the value of business assets by up to 100 percent if the business qualifies

- Agricultural Relief applies to farmland and related property

These reliefs are complex and subject to strict conditions, but when applicable, they can allow family-owned businesses or farms to pass to the next generation with minimal tax exposure.

7. Structuring Ownership of the Family Home

In some cases, the way in which the family home is owned can affect inheritance tax. For example:

- Tenants in Common ownership allows each parent to leave their share of the property to different beneficiaries or into a trust

- Structuring the home to pass directly to children or grandchildren may qualify it for the Residence Nil-Rate Band

It is important to ensure that home ownership structures are regularly reviewed, particularly after the death of the first parent or significant changes in property value.

Conclusion

Inheritance tax when the second parent dies can be a significant financial concern for families in the UK.

While the tax system offers reliefs such as the nil-rate band, residence nil-rate band, and spousal transfer, proactive planning is vital to reduce liabilities.

By understanding how the rules work and using available strategies, families can protect more of their legacy and ensure that loved ones receive the maximum possible inheritance.

Frequently Asked Questions

What happens to inheritance tax if both parents die together?

If both parents die simultaneously and their estates are passed to children or other beneficiaries, the combined estate will be assessed for inheritance tax. The unused nil-rate bands and RNRBs may still apply, depending on how the estate is structured and whether Wills are in place.

Can inheritance tax be avoided entirely with planning?

While inheritance tax may not be completely avoidable, strategic planning through gifting, trusts, and insurance can significantly reduce the liability or defer it across generations.

Do adopted or stepchildren get the same inheritance tax benefits?

Yes, adopted children, stepchildren, and foster children are recognised as direct descendants for the purposes of RNRB, allowing estates to benefit from the full allowance when the family home is passed on.

How do you claim the transferable nil-rate band?

The executor or personal representative must apply to HMRC to transfer any unused nil-rate band from the first spouse or civil partner. Documentation such as the death certificate and details of the first estate are required.

Are pensions subject to inheritance tax in the UK?

Most pensions are not subject to inheritance tax if they are passed outside of the estate. However, some circumstances may lead to taxation, especially if the pension is in drawdown or if the death occurs after the age of 75.

Does a house left in a Will always qualify for RNRB?

No, the RNRB only applies if the home is left to direct descendants. If the property is left to others, such as siblings or friends, the RNRB does not apply, and only the standard nil-rate band is available.

When is inheritance tax due after the second parent’s death?

Inheritance tax is usually due within six months of the end of the month in which the person dies. After this period, HMRC may charge interest on any unpaid tax.