DWP Bank Holiday Payment Dates: Full Schedule and What to Expect

More than 20 million people across the UK receive financial support from the Department for Work and Pensions (DWP) or HM Revenue and Customs (HMRC).

For those who rely on these benefits, knowing when payments are due, especially around bank holidays, is essential for effective financial planning.

Payment schedules can shift significantly during public holidays. Understanding how these changes affect your benefits is crucial to avoid confusion and ensure that funds are available when needed.

Below is a comprehensive guide to upcoming changes in DWP bank holiday payment dates, how they impact your income, and what steps to take if your payment is delayed.

What Are The Upcoming Bank Holidays Affecting DWP Payments?

In the UK, August brings key bank holidays that directly influence when benefits are paid. Payments scheduled on a bank holiday will typically be processed earlier to avoid delays in receiving vital income support.

Two key dates to note for August 2025 are:

- Monday, 4 August (Scotland only)

- Monday, 25 August (UK-wide)

When benefits are due on these days, recipients can usually expect the money to arrive on the last working day before the holiday. This means:

- Payments due on 4 August will likely be made on Friday, 1 August

- Payments due on 25 August will likely be made on Friday, 22 August

These adjustments apply across most types of benefit payments administered by the DWP and HMRC.

When Will DWP Payments Be Made If There’s A Bank Holiday?

DWP follows a clear policy when it comes to rescheduling payments around public holidays. If a payment date falls on a weekend or bank holiday, the money is usually issued on the last working day before that date.

This helps ensure that recipients have access to their benefits when banks and DWP offices are closed.

Here is a table showing how payment dates may shift in August 2025:

| Original Payment Date | Revised Payment Date | Region Affected |

| Monday, 4 August | Friday, 1 August | Scotland only |

| Monday, 25 August | Friday, 22 August | UK-wide |

These changes are part of DWP’s routine adjustments and apply to most benefit types.

Claimants need to factor these changes into their budgeting plans, especially if payments are made early.

Which DWP And HMRC Benefits Are Affected By Bank Holidays?

Most recurring benefit payments are affected by bank holidays. These include both weekly and monthly disbursements managed by DWP and HMRC.

The impact of bank holidays depends on the frequency of the specific benefit and its usual due date.

Commonly affected benefits include:

- Attendance Allowance: Paid every four weeks

- Carer’s Allowance: Paid weekly or every four weeks

- Child Benefit: Paid every four weeks or weekly for eligible single parents

- Disability Living Allowance: Paid every four weeks

- Employment and Support Allowance (ESA): Paid every two weeks

- Income Support: Paid every two weeks

- Jobseeker’s Allowance (JSA): Paid every two weeks

- Pension Credit: Paid every four weeks

- Personal Independence Payment (PIP): Paid every four weeks

- State Pension: Paid every four weeks

- Tax Credits: Paid weekly or every four weeks

- Universal Credit: Paid monthly

If any of these benefits are due on a bank holiday, the payment is generally issued on the working day before the holiday.

No extra payments are made. The frequency and amount remain the same.

How Is The State Pension Payment Date Decided In The UK?

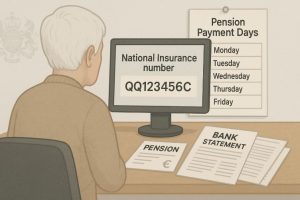

The day your state pension is paid depends on the last two digits of your National Insurance (NI) number.

Each range of numbers corresponds to a day of the week. This structured approach helps the DWP spread payments efficiently across the week.

Here is a detailed table outlining the schedule:

| Last Two Digits of NI Number | Day of the Week Payment is Made |

| 00 to 19 | Monday |

| 20 to 39 | Tuesday |

| 40 to 59 | Wednesday |

| 60 to 79 | Thursday |

| 80 to 99 | Friday |

If the designated day falls on a bank holiday, your pension will usually be paid on the previous working day.

The timing of this change depends on your exact payment schedule and the bank holiday calendar in your region.

What Should You Do If Your Benefit Payment Doesn’t Arrive?

In the event that your benefit payment fails to appear on the expected day, it’s important to remain calm and take the proper steps.

Payment delays can occur for several reasons, including bank processing errors or administrative issues.

Here are actions you can take:

- Check your bank account for delayed postings

- Confirm whether the scheduled payment date coincides with a bank holiday

- Review messages or letters from DWP or HMRC regarding schedule changes

If the issue persists, contact the appropriate helpline. Note that most DWP offices and helplines are closed on bank holidays.

Important contact numbers include:

Universal Credit

- Phone: 0800 328 9344

- Welsh Language: 0800 012 1888

- Textphone: 0800 328 1344

Child Benefit

- Phone: 0300 200 3100

- From abroad: +44 161 210 3086

Tax Credits

- Phone: 0345 300 3900

- From abroad: +44 2890 538 192

JSA, ESA, Income Support

- Phone: 0800 169 0310

- Textphone: 0800 169 0314

- Relay UK: 18001 then 0800 169 0310

When calling, have your National Insurance number, benefit details and personal identification ready. If you cannot get through on the bank holiday itself, try calling on the next working day.

Will Bank Holidays Delay Universal Credit Payments?

Universal Credit is a monthly payment designed to support individuals and families with living costs.

While the payment date usually stays consistent each month, bank holidays can cause delays or schedule changes. It’s important to know how this works to avoid being caught off guard.

How Are Universal Credit Payment Dates Determined?

Universal Credit is paid once a month into the claimant’s chosen bank account.

The first payment is usually made seven days after the end of your first assessment period, and future payments arrive on the same date each month.

However, if the monthly payment date falls on a Saturday, Sunday, or bank holiday, the DWP issues the payment on the last working day before that date.

This means that although you receive the payment earlier than expected, the amount and assessment period remain unchanged.

Example: Payment Adjustment Due to a Bank Holiday

If your usual payment date is Monday, 25 August 2025, which is a UK-wide bank holiday, then:

- You can expect your Universal Credit to arrive on Friday, 22 August 2025

This early payment doesn’t change the next payment date, which will still be based on your original assessment cycle.

That means the next month’s payment won’t come sooner, creating a slightly longer gap between disbursements.

Are There Exceptions to Early Universal Credit Payments?

In most cases, the DWP automatically adjusts Universal Credit payments for bank holidays. However, delays can still occur due to:

- Bank processing issues

- Incorrect account information

- Administrative errors

It’s advisable to check your online Universal Credit journal or account regularly for payment updates and confirmation messages from DWP.

Are There Different Rules For Scotland And Northern Ireland?

Benefit payment schedules across the UK are generally consistent, but there are regional variations that may impact when and how benefits are paid, especially during public holidays.

Claimants living in Scotland and Northern Ireland should be particularly mindful of these differences, as both countries observe different bank holidays compared to England and Wales.

How Bank Holidays Differ Across The UK?

Each UK nation has its own set of official public holidays. While some are shared across the UK (such as New Year’s Day and Christmas), others are nation-specific.

For example:

- Scotland observes a Summer Bank Holiday on Monday, 4 August, which is not recognised in England, Wales, or Northern Ireland.

- Northern Ireland has additional holidays like St Patrick’s Day (17 March) and the Battle of the Boyne (12 July).

Because of these local holidays, DWP and HMRC may issue payments earlier or on a different day for residents of these regions. It’s essential for claimants to stay informed about local holiday dates and plan finances accordingly.

How DWP Adjusts Payments In Scotland?

Residents in Scotland are subject to earlier payment dates when Scottish bank holidays impact normal schedules. For instance, if a payment is due on Monday, 4 August 2025 (a Scottish bank holiday), the benefit will likely be issued on Friday, 1 August 2025.

The DWP uses regional calendars to automatically adjust payments, but recipients should still verify their payment date using:

- Their online Universal Credit account

- DWP notifications (texts, letters, or online messages)

- Bank statements or digital alerts

Scottish claimants should also note that Scottish bank holidays do not necessarily impact benefit schedules in England or Wales, so information shared on UK-wide platforms may not always apply regionally.

How DWP Adjusts Payments In Northern Ireland?

Northern Ireland’s public holidays can also affect benefit payment dates. For example, if your benefit is due on a Northern Ireland-specific holiday like 12 July (Battle of the Boyne), DWP or HMRC will likely process the payment on the previous working day.

The Social Security Agency (SSA) in Northern Ireland administers benefits slightly differently from DWP, although most payments still follow similar rules:

- Payments due on local public holidays are often made early

- There may be additional processing time due to regional administrative procedures

Claimants in Northern Ireland are encouraged to check benefit schedules on the nidirect.gov.uk portal, which offers region-specific information and guidance.

Staying Informed About Regional Adjustments

Because of these differences, benefit recipients in Scotland and Northern Ireland should not rely solely on UK-wide announcements or media headlines. Instead, they should:

- Monitor regional government websites (e.g. mygov.scot and nidirect.gov.uk)

- Contact local DWP offices or helplines for confirmation

- Review payment notifications in advance of any regional holiday

This helps ensure there are no surprises and allows for better financial planning around early payments or delayed deposits due to local observances.

How Can You Prepare In Advance For DWP Holiday Payment Changes?

While the DWP typically issues payments early before bank holidays, the gap until your next scheduled payment may be longer than usual. Effective planning is essential to avoid financial stress during this period.

Track Key Payment Dates Using Official Sources

Stay up to date with all bank holiday changes by checking the official GOV.UK calendar. These dates are confirmed in advance and provide a reliable schedule for:

- Bank holidays across the UK, Scotland, and Northern Ireland

- Revised DWP payment dates

- Service closures for benefit helplines

Having this information at your fingertips helps you anticipate when to expect early or delayed payments.

Budget Effectively for Longer Gaps Between Payments

Receiving your benefit payment early might seem like a bonus, but it creates a longer wait before the next cycle. Careful budgeting can help you manage your finances efficiently.

Here are some useful budgeting tips:

- Divide your payment into weekly allowances to stretch your funds across the month

- Avoid major expenses immediately after receiving an early payment

- Set aside a small emergency reserve if possible, especially in holiday months

This approach ensures you don’t run short before your next benefit is due.

Use Online Banking and Alerts to Monitor Your Account

Digital banking tools allow you to keep track of incoming benefit payments in real time. Set up:

- Push notifications or email alerts for deposits

- Standing order reviews to align direct debits with early payment dates

- Monthly reminders for payment tracking

These features help you remain aware of your financial status and avoid overdraft fees or missed payments.

Plan Around DWP And HMRC Service Closures

During bank holidays, most DWP and HMRC offices are closed, and customer helplines are unavailable. If you experience payment issues, there could be delays in resolving them.

To prepare:

- Contact DWP in advance if you suspect a problem with your benefit

- Avoid scheduling essential payments or direct debits close to a holiday

- Check the DWP website or your online account for updates and announcements

This preparation ensures you’re not caught out by office closures and service unavailability.

Conclusion

Bank holidays often bring welcome breaks but can lead to confusion when it comes to DWP and HMRC benefit payments. Understanding how these dates affect your schedule especially in August 2025—can help avoid stress and missed bills.

If your benefit payment is due on a bank holiday, you will most likely receive it earlier. Always double-check your payment schedule and reach out to the relevant helpline if anything seems amiss.

Frequently Asked Questions

What if my payment date falls on both a weekend and a bank holiday?

If your scheduled payment falls on both a weekend and a bank holiday (e.g. a Monday following a weekend), the DWP or HMRC will usually issue your payment on the Friday before.

Do early payments mean I’ll receive less money?

No. Early payments are the full amount you are entitled to; they are simply rescheduled, not reduced.

Will direct debits adjust automatically for early benefit payments?

Direct debits are not adjusted automatically. It’s essential to ensure you have enough funds in your account on the due date to avoid overdraft charges.

Can I check my new payment date online?

Yes, you can check your benefit payment schedule by logging into your Universal Credit or HMRC online account.

What happens to payments for newly approved benefits during holidays?

If your claim is newly approved, your first payment may be delayed slightly if it coincides with a bank holiday, depending on processing times.

Are bank holiday changes the same every year?

Not necessarily. Bank holidays vary year by year and by region. It’s best to consult the official GOV.UK calendar for up-to-date information.

Do DWP text or email about changed payment dates?

DWP may send out notifications via text, letter or your online account, but it’s not guaranteed. Always check your payment history proactively.