Monzo Cost of Living Payment Explained: Who Gets It and When?

The cost of living crisis in the UK has significantly impacted households across the country.

While the government introduced targeted support schemes, many turned to digital banks like Monzo for quicker access to funds and financial tools.

Monzo doesn’t issue these payments but facilitates early access through features like “Paid Early”.

Understanding how these payments are processed, who qualifies, and what support remains in 2025 is crucial for customers relying on financial stability.

What Is the Monzo Cost of Living Payment?

The phrase “Monzo Cost of Living Payment” is often misunderstood. Monzo itself does not issue cost-of-living payments to customers.

Instead, it plays a supportive role in helping users access official government-issued cost of living support more efficiently.

In 2022, Monzo did award a one-off £1,000 payment to its lowest-paid employees.

This internal initiative was introduced to support Monzo’s staff during the cost of living crisis and rising inflation.

However, this payment was not extended to customers and should not be confused with government support schemes.

Monzo’s actual role for customers is in facilitating cost of living payments that are issued by the UK Government.

These include payments from the Department for Work and Pensions (DWP) and His Majesty’s Revenue and Customs (HMRC).

Monzo can help customers receive these payments faster through features like Paid Early, but the bank is not responsible for issuing the funds or determining eligibility.

Who Is Eligible for the Cost of Living Payments with Monzo?

Eligibility for the cost of living payments is based solely on criteria set by the UK Government. Monzo does not influence or assess who qualifies for these payments.

Government cost of living payments are issued to individuals who receive specific means-tested benefits. The most common eligible benefits include:

- Universal Credit

- Pension Credit

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Income Support

- Child Tax Credit

- Working Tax Credit

If a Monzo customer receives any of these qualifying benefits and has chosen to have them paid into their Monzo account, the government will send the payment there.

The important point to note is that a Monzo account is not required to receive cost of living payments. Any bank account that accepts government BACS payments will suffice.

Monzo’s role begins once the DWP or HMRC sends a BACS payment. The bank then ensures smooth processing, with features like payment notifications and early access where applicable.

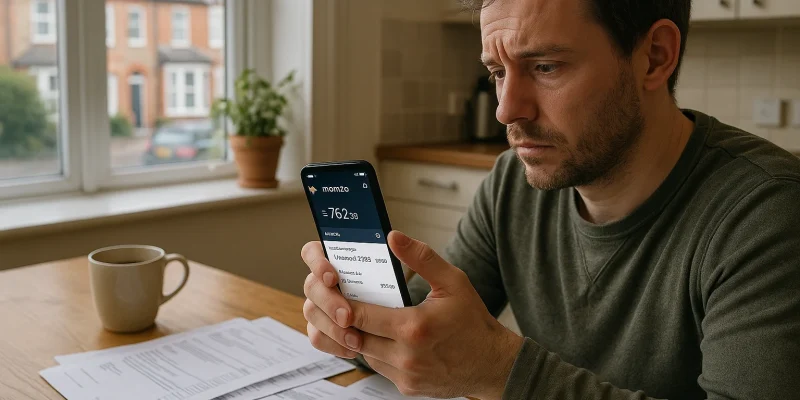

How Does Monzo’s “Paid Early” Feature Work for Cost of Living Payments?

The Paid Early feature is a standout functionality in Monzo’s service. It allows eligible BACS payments to be received up to 24 hours before their scheduled date. This includes benefits and government support such as cost of living payments.

When a BACS payment is detected by Monzo, customers are notified via the mobile app. From 4 pm the day before the official payment date, customers can choose to have the funds made available immediately.

This feature can be particularly useful for:

- Gaining access to funds before weekends or public holidays

- Managing bills and essentials without delay

- Reducing financial stress through better control over timing

Monzo’s Paid Early Feature Overview

| Feature | Details |

| Applies to | BACS payments (e.g. benefits, salary, HMRC support) |

| Notification time | From 4 pm the day before official payment date |

| User action required | Tap the notification to enable early payment |

| Availability | Available to all Monzo personal account holders |

The feature does not change the payment amount or eligibility, but it provides a helpful layer of flexibility for those who need it most.

When Did the Cost of Living Payments Stop?

The UK Government introduced the Cost of Living Payment scheme in 2022 as part of a broader support package for low-income households. Payments were issued in several rounds through 2022, 2023, and the start of 2024.

These payments were not indefinite. The final scheduled payments were made in 2024, and as of now, no new cost of living payments are planned for 2025.

Timeline of UK Government Cost of Living Payments

| Payment Period | Amount | Eligible Groups | Administered by |

| July 2022 | £650 | Universal Credit, Pension Credit, etc. | DWP |

| November 2022 | £324 | Same | DWP |

| Spring 2023 | £301 | Same | DWP |

| Autumn 2023 | £300 | Same | DWP |

| Early 2024 | £299 | Same | DWP |

These payments were part of a response to economic challenges caused by inflation, energy price hikes, and global financial uncertainty.

The programme officially ended with the 2024 payment cycle, and there has been no government confirmation regarding future schemes for 2025.

What Other Financial Support Does Monzo Offer?

Although Monzo does not issue cost of living payments directly to its customers, the bank does provide several forms of assistance for those facing financial challenges.

These services are part of Monzo’s broader mission to improve financial wellbeing and provide meaningful support where needed.

Customers who are struggling with their finances can access the following:

- Specialist Support Team: Accessible through the in-app chat, Monzo’s trained staff can offer tailored advice and guidance for those in financial difficulty

- Money Worries Hub: This section of the Monzo website provides detailed information on dealing with income changes, financial hardship, and setting priorities

- Flexible Budgeting Tools: The Monzo app helps users set budgets, track spending, and save automatically

- Overdraft Support: Monzo provides arranged overdrafts with transparent limits and charges, which can serve as a buffer in emergencies

- Loan Adjustments: Customers with active Monzo loans may request help, such as repayment holidays or restructuring, based on their financial situation

These features are not exclusive to those receiving benefits. Monzo encourages any customer facing hardship to seek help, and its tools are available to all users through the app and website.

Where Else Can Customers Get Help with the Cost of Living?

For broader cost of living assistance beyond Monzo, there are several official and third-party support systems available across the UK.

The government may have concluded its Cost of Living Payment programme, but individuals still have access to local and national resources that can provide meaningful support.

Useful sources of help include:

- Local Authorities: Councils can provide emergency support, discretionary housing payments, and food or fuel vouchers based on individual assessments

- GOV.UK: The government’s main website provides up-to-date information on any new support schemes, as well as eligibility checkers for benefits

- Citizens Advice: Offers practical and legal advice on financial rights, debt management, and housing

- Turn2Us: Provides a searchable database of grants and benefit support based on postcode and circumstances

- StepChange: A charity offering free debt advice and tailored plans for repayment or financial restructuring

The financial impact of inflation and rising costs has led many to seek alternative forms of support. These organisations operate alongside financial institutions like Monzo to provide a safety net for those in need.

How Can Monzo Customers Stay Informed?

To stay updated about their finances and potential support options, Monzo customers are encouraged to use the range of informational features available in the app and on the website.

Monzo’s mobile app is the central hub for all notifications, payment alerts, and product updates.

Customers can expect to receive alerts when a payment is on its way, when they’ve gone into overdraft, or when their spending approaches a set limit.

Additional channels of information include:

- In-app help centre: Offers answers to frequently asked questions and issues

- Live chat support: Allows customers to speak with a Monzo team member in real time

- Blog and update posts: Periodically cover financial topics, new features, and support tips

- Money Worries page: Updated as new tools and support become available

These systems are designed to provide peace of mind and clarity, particularly during periods of financial uncertainty.

Conclusion

Monzo has proven to be a valuable partner for many during periods of financial uncertainty.

Although the government’s Cost of Living Payment scheme ended in 2024, Monzo continues to support customers through its smart banking features and dedicated assistance teams.

From early access to payments to budgeting tools, Monzo helps users manage money more effectively.

Staying informed about available resources, both through Monzo and official channels, is key to navigating the ongoing challenges of rising living costs.

Frequently Asked Questions

How do I know if my Cost of Living Payment is arriving in my Monzo account?

You’ll receive a notification from Monzo when a BACS payment is due. You can also view upcoming payments in the app under the “Payments” tab.

Can I still get help from Monzo if the government has stopped Cost of Living Payments?

Yes. Monzo offers customer support for financial hardship, including their Specialist Support Team, budgeting tools, and guidance via their Money Worries hub.

Will the government restart Cost of Living Payments in the future?

There are currently no official plans for further payments in 2025. Future announcements will be made via GOV.UK and relevant departments.

What benefits qualify for early payment through Monzo?

Any BACS-based payment, including Universal Credit and Tax Credits, may be eligible for Monzo’s “Paid Early” feature.

Is the £1,000 cost of living support from Monzo still available?

No. That payment was a one-off issued to Monzo staff in 2022 and is not available to customers.

Do I need to apply to get paid early with Monzo?

No application is needed. If your payment qualifies, Monzo will notify you automatically and give you the option to receive it early.

Where can I find government support if I’m not with Monzo?

All UK residents can access support through their local council, Citizens Advice, or GOV.UK, regardless of who they bank with.