Can a Bailiff Force Entry for Council Tax in the UK?

Council tax arrears are a growing issue across the UK, and many individuals find themselves uncertain about their rights and the powers held by enforcement agents.

When council tax remains unpaid, local authorities may employ bailiffs (now formally referred to as enforcement agents) to recover the debt.

But how far can they go? Specifically, can a bailiff force entry into a home for unpaid council tax?

Understanding the legal rights of both the debtor and the enforcement agent is crucial.

This guide aims to offer a clear, accurate, and legally grounded explanation of what to expect if you’re dealing with council tax debt and a potential visit from a bailiff.

What Is a Bailiff and What Powers Do They Have for Council Tax Debt?

A bailiff, legally known as an enforcement agent, is an individual authorised to act on behalf of a creditor to recover unpaid debts.

In the case of council tax, bailiffs are typically employed by private enforcement companies on behalf of local authorities.

Once a council tax bill goes unpaid, and a liability order is obtained through a magistrates’ court, the council is legally permitted to instruct a bailiff to recover the amount due.

Bailiffs have several powers, but these are tightly regulated under the Tribunals, Courts and Enforcement Act 2007 and the Taking Control of Goods Regulations 2013. Their powers include:

- Visiting a debtor’s property to collect overdue council tax

- Requesting full payment or agreeing to a repayment plan

- Seizing goods and listing them under a Controlled Goods Agreement (if peaceful entry is made)

- Selling goods to recover the debt if repayment is not made

They cannot act outside the scope of these powers. Their conduct and actions must follow a strict code, and any breach can be challenged by the debtor.

Can a Bailiff Enter Your Home for Council Tax Debt in the UK?

Enforcement agents can visit a residential property in relation to unpaid council tax.

However, they are not automatically allowed to enter the property. Their right to enter is limited to what is known as peaceful entry, which means they can only enter if:

- Someone lets them in voluntarily through an unlocked door

- A door is open and they step inside without force or trickery

- They gain access through an unlocked garage or outbuilding

They cannot enter through windows, climb fences, or push past you at the door. If the home is locked and no one lets them in, they must leave and attempt re-entry at a later date.

Once peaceful entry is gained, bailiffs may take control of goods or issue a Controlled Goods Agreement, allowing the debtor to retain possession of items as long as payments are made. This legal entry also sets the stage for further action if terms are not met.

Under What Circumstances Can a Bailiff Use Force to Enter a Property?

For council tax debt, forced entry is almost never permitted. Bailiffs cannot break doors, smash windows, or use locksmiths to gain entry for unpaid council tax, unless specific legal conditions are met. The general rule is that entry must be peaceful and respectful of your rights.

There are a few exceptions where force may be used, but not typically for council tax. These include:

- Unpaid criminal fines

- VAT or tax debts owed to HMRC

- Business premises with prior entry granted

In cases where the bailiff has previously entered your home through peaceful means and secured a Controlled Goods Agreement, they may re-enter using reasonable force if you break the agreement. Even then, this must be legally justified and proportionate.

| Condition | Can Bailiff Use Force? | Explanation |

| Council Tax Debt (Initial Visit) | No | Only peaceful entry allowed |

| Council Tax Debt (After CGA Breach) | Possibly | Must have previously entered peacefully |

| Unpaid Criminal Fines | Yes | Court order may allow forced entry |

| Business Premises (Non-residential) | Yes | Can use force if appropriate and authorised |

It is important to understand that forced entry in residential council tax cases is extremely rare and would typically require legal justification and oversight.

What Are Your Rights When a Bailiff Visits for Council Tax?

When a bailiff, also known as an enforcement agent, visits your home in connection with unpaid council tax, it’s essential to understand your legal rights.

These rights are protected under UK legislation and are designed to ensure that enforcement is carried out fairly, transparently, and without abuse of power.

Knowing your rights can help you stay calm, make informed decisions, and avoid unnecessary escalation during a stressful situation.

You Have the Right to Be Notified in Advance

Before any visit takes place, you must receive a Notice of Enforcement. This is a formal letter that gives you at least seven clear days’ notice (not including Sundays or bank holidays) before a bailiff can attend your property.

The notice must include:

- The name of the creditor (in this case, your local council)

- Details of the debt owed

- A clear statement that enforcement action will be taken if the debt is not resolved

- The date and time after which a bailiff may visit

If this notice hasn’t been received or was sent incorrectly, the bailiff visit may be unlawful.

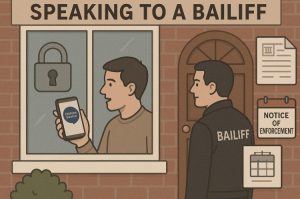

You Have the Right to Verify the Bailiff’s Identity and Authority

When a bailiff arrives, you are legally entitled to ask for identification and proof of their authority. This can be done without opening the door — you may speak through a letterbox or a nearby window.

You can ask to see:

- Their enforcement agent certificate (issued by a county court)

- Photo ID

- A copy of the liability order authorising enforcement for your council tax debt

- The name of the company they work for

If the bailiff cannot provide valid documents, you can ask them to leave and report the visit to your local council or the Civil Enforcement Association.

You Have the Right to Refuse Entry to Your Home

One of the most important rights is that you are not legally required to let a bailiff into your home especially on their first visit.

For council tax debts, bailiffs are only allowed to enter through peaceful entry, which means:

- Through an unlocked door

- If someone inside lets them in voluntarily

They cannot:

- Force their way in by breaking down the door

- Enter through windows

- Push past you at the doorway

- Climb walls or fences

If you do not grant access, they must leave and either return at a later date or escalate the process through other legal means.

It is entirely lawful for you to speak through a closed door and refuse access without facing any penalty.

You Have the Right to Protection of Essential and Exempt Goods

Bailiffs are restricted in terms of what they can take. If they are allowed inside, they may list non-essential possessions under a Controlled Goods Agreement, but they cannot seize or remove items that are considered essential for basic living or protected by law.

These include:

- Clothing, bedding, and basic household items (e.g., cooker, fridge)

- Items belonging to children

- Medical or mobility equipment

- Tools and equipment necessary for work (up to a certain value)

If any of these are taken or threatened, you have the right to file a complaint and seek immediate advice.

You Have the Right to Be Treated Fairly and Without Harassment

Bailiffs must behave in a professional, non-threatening manner at all times. They are required to comply with the Taking Control of Goods: National Standards, which outlines appropriate conduct, including:

- Visiting only between 6 am and 9 pm (unless court-approved to do otherwise)

- Not using aggressive or intimidating language

- Not visiting if the household is known to be vulnerable (e.g., due to age, disability, or mental health)

If you feel harassed, threatened, or unsafe during a visit, you are within your rights to:

- End the conversation

- Contact the enforcement company directly

- Call your local council to report the incident

- Seek legal advice or contact Citizens Advice immediately

You Have the Right to Request a Breakdown of Charges

Bailiffs are allowed to charge fees, but these must be transparent, reasonable, and aligned with legal standards. You can request a written breakdown of all charges, which may include:

- Compliance stage fee (typically £75)

- Enforcement stage fee (typically £235)

- Sale or disposal stage fee (if goods are removed)

These charges cannot be added arbitrarily, and excessive or duplicate fees are unlawful.

If you suspect overcharging, request written documentation and escalate the matter through a formal complaint if necessary.

You Have the Right to Dispute the Debt or Enforcement Action

If you believe that:

- You do not owe the council tax

- The amount claimed is incorrect

- Proper procedure was not followed (e.g., you didn’t receive the Notice of Enforcement)

You have the right to challenge the action and request a hold on enforcement until the dispute is resolved.

In such cases, contact your local council’s revenue department, or seek assistance from a legal advisor or debt charity.

You Have the Right to Legal and Charitable Support

You do not have to deal with a bailiff alone. There are many organisations that can offer free, confidential advice and help you handle enforcement actions more effectively.

These include:

- Citizens Advice

- National Debtline

- StepChange Debt Charity

- Local welfare support teams

If you’re classed as vulnerable, these organisations can often negotiate directly with the bailiffs on your behalf and request that enforcement action be paused or cancelled.

How Can You Stop a Bailiff from Entering Your Property?

Stopping a bailiff from entering your home often depends on acting quickly and understanding the enforcement process. There are multiple ways to prevent enforcement agents from escalating action or entering your home.

Before a bailiff visits, you should have received a Notice of Enforcement. This letter provides a minimum of seven clear days’ notice before they can attend your property.

To prevent them from entering:

- Keep all doors locked and do not allow access unless you’ve received advice

- Speak to them through the letterbox or an upstairs window

- Offer to make a payment directly to the council, bypassing enforcement agents

- Explain any vulnerability in the household, such as disability, illness, or financial hardship, which could qualify for protective measures

Many councils are willing to negotiate payment terms directly and stop enforcement if a genuine effort is made.

| Action Taken | Impact on Bailiff Entry | Notes |

| Paying the debt in full | Stops enforcement immediately | Payment must be verified |

| Setting up a payment plan with the council | Pauses or cancels enforcement | Agreement must be honoured |

| Informing of vulnerability | Enforcement may be suspended | Must provide proof or evidence |

| Ignoring the situation | Enforcement continues and fees rise | Not recommended; leads to further complications |

Bailiffs cannot take action if you are actively engaging with the council or legal advisers. The earlier you act, the better the outcome.

What Should You Do If a Bailiff Has Already Entered Your Home?

If a bailiff has already entered your home using peaceful methods, they can list goods under a Controlled Goods Agreement (CGA). This document allows the bailiff to take control of certain items but leaves them in your possession as long as you adhere to a repayment plan.

In this case:

- You should review the agreement carefully before signing

- Ensure only goods you own are listed; third-party belongings should not be included

- Keep up with the agreed payments to avoid further action

- Store a copy of the CGA and monitor any follow-up communication

If you default on the CGA, the bailiff may return and remove the listed goods. They are allowed to use reasonable force to re-enter the property if entry was initially granted and you have not fulfilled your obligations under the agreement.

Should you believe the agreement was entered under duress or includes inappropriate goods, you can raise a formal complaint with the enforcement agency and seek legal redress.

It is also advisable to get assistance from debt advisors or organisations like Citizens Advice.

How Can You Resolve Council Tax Debt Without Bailiff Intervention?

Council tax debt can be resolved before bailiffs are even involved, provided action is taken early. Local authorities often offer support schemes and flexible repayment options that can prevent enforcement escalation.

Steps to resolve council tax debt:

- Contact your local council: Explain your situation and ask to arrange a manageable repayment schedule

- Apply for council tax support: Many councils offer discounts or exemptions for low-income individuals or families

- Consolidate debt through financial planning: Explore budgeting, debt relief orders, or individual voluntary arrangements (IVAs) through a debt advisor

- Work with a registered charity: Organisations such as StepChange or National Debtline offer free advice and intervention services

By tackling the debt early, you reduce the likelihood of enforcement fees, emotional stress, and the potential seizure of your property.

Councils prefer recovering debts through voluntary agreements rather than incurring the cost of bailiff services, so cooperation is in everyone’s interest.

Conclusion

Bailiffs have specific powers when it comes to recovering council tax debts, but those powers are not absolute.

For most cases, enforcement agents are not allowed to force entry into your home. Peaceful entry is required, and debtors have a range of rights and protections under UK law.

If you’re struggling with council tax arrears, early communication with your local council and seeking advice from reputable debt charities like Citizens Advice can make a significant difference.

Knowing your rights and acting promptly can help you avoid the stress and financial burden that often comes with enforcement action.

FAQs

Can bailiffs break in for unpaid council tax?

No, bailiffs cannot legally break in to collect council tax unless they previously entered peacefully and you’ve defaulted on a Controlled Goods Agreement. Even then, forced entry is rare.

How much notice do bailiffs give for council tax debts?

Bailiffs must issue a Notice of Enforcement giving at least seven clear days’ notice before they visit your home.

What happens if I refuse to let a bailiff in?

If entry is refused, the bailiff may return later or apply further fees. However, they cannot force entry unless previously permitted under certain conditions.

Are bailiffs allowed to enter when I’m not home?

No, bailiffs cannot enter a property when no one is present unless they are recovering criminal fines and have a specific court order.

How can I negotiate with a bailiff for council tax arrears?

You can propose a payment plan directly or through the council. If accepted, you may avoid enforcement or enter a Controlled Goods Agreement.

Can a bailiff take my car for unpaid council tax?

Yes, bailiffs can clamp and remove vehicles if they are parked on a public road or drive. However, vehicles essential for work or adapted for a disability may be exempt.

What is a controlled goods agreement and how does it work?

A Controlled Goods Agreement allows a debtor to keep listed items while repaying the debt in instalments. If payments are missed, the bailiff can return to seize the goods.