European Medical Cannabis Markets Shifting Away from Flower – What That Means for the UK Sector?

Legal medical cannabis in the UK is a booming sector, with an estimated 80,000 people now treating with cannabis or derived medications prescribed by licensed private clinics. That number is only set grow, with the amount of prescribed cannabis flower by weight growing 262% between 2022 and 2025.

The UK is currently the second largest medical cannabis market in Europe, behind only Germany, and it is worth hundreds of millions of pounds a year. However, big changes could soon be coming for the UK sector.

Principally because two big new markets are set to open in 2025, in Spain and France. And the way these two European neighbours have chosen to deal with regulating the market is something new.

This piece will look at what these markets are doing (essentially moving away from medical flower) and how that could influence the UK sector going forward.

France and Spain Both Move to Legalise With Caveats

Both France and Spain will be legalising medical cannabis this year, or at least barring unexpected changes of policy in government. However, both countries have largely snubbed unrefined flower.

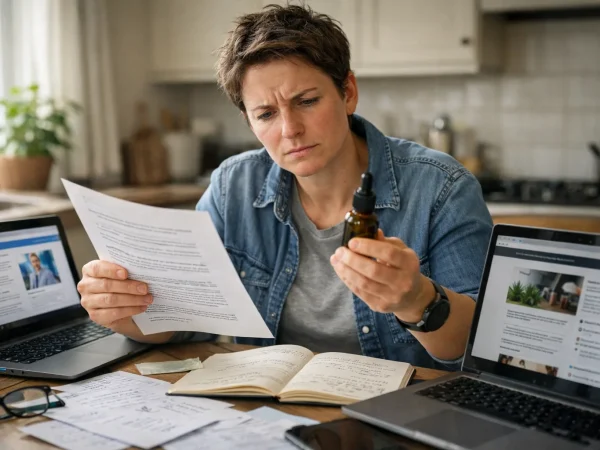

In comparison, in the UK some 77% of prescriptions are for medical cannabis flower. Although fully-licensed private clinicians will usually recommend beginning treatment with oils, sprays or lozenges, it is up to the patient if they would like vaped flower. After qualifying consultation and prescription, the clinic will organise delivery to patients’ doors.

In Spain the draft legislation leaves only standardised oils as options, which will be bottled and dispensed from state hospitals.

The decision to not allow telehealth prescriptions has been criticised by campaign groups including patient groups and several pharmacy associations, who are challenging the model in court. So, things could change on the dispensing level. But, the exclusion of cannabis flower is likely to remain.

Meanwhile France has also excluded prescription medical cannabis flower for the most part. Although it will legalise this year, the first prescriptions are unlikely to roll out until 2027. That’s because France is completely integrating cannabis into the national healthcare pharmaceutical framework.

This has its advantages, wide access from the start, clear rules for businesses and patients, but it also means a very pharmaceutical approach.

Which will delay the launch and possibly stifle some innovation as products need to be certified by the medicines regulator. That also means flower is mostly off the (treatment) table for French patients.

As well as oils, pre-loaded cartridges with measured doses of specific strains of flower will be allowed for medically certified vaporisers.

Clinical Transformation for Medical Cannabis, to Distinguish From the Recreational

These steps in part, are a response to issues in medical markets like the UK, where medical cannabis and patients are still subject to the stigmas attached to recreational use on the black market.

If they become the future blueprint for medical legalisation in Europe, the UK market may feel pressured to adapt. Any medical cannabinoids dispensary in the UK today has to balance profits and the mission of patient access, while strictly not being a pseudo recreational market.

Different clinics approach this in slightly different ways. However, the qualifying standards are consistent, and a professionally put together treatment plan from a licensed healthcare provider will always be vastly different from illicit self medication.

Limiting flower to pre-dosed capsules for vaporisers is part of this drive towards the pharmaceuticalisation of cannabis.

Oils, extracts and healthcare certified devices offer the following advantages over raw flower in this aspect:

- Consistent cannabinoid levels

- Simple to regulate dosages

- More discreet for patients and the public

- Less likely to receive negative media attention

These changes might seem small to someone unfamiliar with the medical cannabis business. However, if this model of legalisation takes off, the economic consequences for the UK could be huge. Potentially in both good and bad ways.

Liquid Inhalation or Dosed Flower Cartridges Could Prove to Be the Middle Ground

The UK is one of the largest producers and the second largest exporter of medical cannabis in the world.

Although much of it has been for pharmaceutical use, which is not suitable for direct patient supply, hopes in the business have been that domestic expertise, tech and infrastructure in cultivation could be converted to delivery for the medical patient market.

That would be huge for UK businesses, potentially to the order of several billion pounds after a few years.

However, if the European market does begin to move away from flower and towards medicalised methods of treatment, this could leave the UK with a large stockpile of medical cannabis that isn’t as valued as once thought.

Of course, the country’s clinics could pivot as an outlier and market their choice as freedom for patients. Or, they could embrace the new, at scale. UK clinics are already developing liquid spray dispensers and preloaded vaporiser cartridges in anticipation of a potential market shift.

Either way, the medical cannabis market in the UK has room to grow. Innovation-driving clinics will be working to stay ahead of the game so they can continue ensuring access to medical cannabis for people who need it.