DWP Christmas Bonus £800: Clearing the Confusion About This Rumour

Every year, as the festive season approaches, discussions about the DWP Christmas Bonus resurface this time with a new twist.

A widely circulated rumour has suggested that the Department for Work and Pensions (DWP) will issue an £800 Christmas Bonus to benefit claimants.

However, this has led to confusion and misunderstanding, especially among those who rely on government support during the winter months.

This article provides a clear and factual breakdown of what the DWP Christmas Bonus actually is, who qualifies, and where the confusion about an £800 payment stems from.

What Is the DWP Christmas Bonus and How Much Is It Really?

The Department for Work and Pensions issues a Christmas Bonus every year to eligible individuals. Contrary to some circulating rumours, the official DWP Christmas Bonus is not £800.

It remains a one-off, tax-free payment of £10, automatically paid into the account where an individual usually receives their benefits.

There is no need to apply for this payment, as it is distributed automatically to those who meet the eligibility criteria.

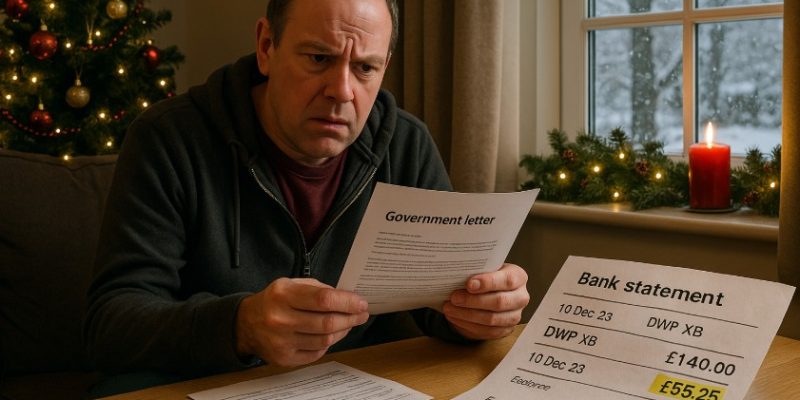

The payment typically arrives in the first full week of December and is a standard, consistent part of the UK’s benefit system. The bonus appears in the bank statement with the code ‘DWP XB’.

Below is a breakdown of the core details:

| Feature | Details |

| Bonus Amount | £10 (one-off) |

| Payment Date | First full week of December |

| Claim Process | Automatically paid to eligible recipients |

| Taxable? | No – tax-free |

| Impact on Other Benefits | None – does not affect other payments |

Despite inflation and increasing financial pressures on households, the bonus amount has not changed since 1972. It has remained £10 for over 50 years, with no confirmed plans for increase.

Why Are People Talking About an £800 DWP Christmas Bonus?

The widespread claim that there is an £800 Christmas Bonus from the DWP is incorrect. This figure has likely arisen due to confusion surrounding other government financial support schemes issued in recent years.

One example is the Cost of Living Payments, which were introduced to support households with rising inflation, energy prices, and other living costs.

While some individuals may have received multiple payments over the course of a year totalling up to £800 or more these are not part of the Christmas Bonus programme.

The confusion often stems from media headlines or social media posts that inaccurately link separate payments under one label.

There are several contributing factors to the £800 rumour:

- Media articles combining Cost of Living payments with standard benefits

- Social media posts misinterpreting government announcements

- Claimants receiving multiple support payments and assuming they’re part of the same scheme

- A lack of clear distinction between recurring benefits and one-off support schemes

This misunderstanding has created unrealistic expectations, especially among new claimants or those unfamiliar with the structure of DWP benefits.

Who Is Eligible for the DWP Christmas Bonus in 2025?

Eligibility for the DWP Christmas Bonus is based on both residency and receipt of a qualifying benefit during the qualifying week, which is usually the first full week of December.

To qualify, a claimant must be:

- Living in the UK, Channel Islands, Isle of Man or Gibraltar during the qualifying week

- Receiving at least one of the eligible benefits during that same week

Here is a list of the main qualifying benefits:

- State Pension

- Disability Living Allowance (DLA)

- Personal Independence Payment (PIP)

- Attendance Allowance

- Carer’s Allowance

- Incapacity Benefit (long-term rate)

- Industrial Death Benefit (for widows or widowers)

- Jobseeker’s Allowance (income-based, with additional criteria)

- Employment and Support Allowance (income-related)

- War Widow’s or War Widower’s Pension

- Widowed Mother’s Allowance or Widowed Parent’s Allowance

If an individual receives multiple qualifying benefits, they still only receive one £10 Christmas Bonus.

The payment is made into the same account where the main benefit is usually received, and no additional paperwork is required.

Are the £800 Payments Linked to Cost of Living Support?

The £800 figure is often connected to a series of Cost of Living Payments issued by the UK government in response to economic challenges and rising living expenses.

These payments are separate from the DWP Christmas Bonus and have different eligibility criteria.

Between 2022 and 2025, the government has issued several support schemes for qualifying individuals:

| Support Type | Payment Amount | Target Group |

| Means-Tested Cost of Living Payment | Up to £650–£900 | Low-income households on benefits |

| Disability Cost of Living Payment | £150 | Individuals on qualifying disability benefits |

| Pensioner Cost of Living Payment | £300 | Pension-age individuals |

Some households received multiple payments, especially if they qualified under more than one category.

This led to some claimants receiving over £800 in one-off payments, but these were not part of or related to the Christmas Bonus.

The confusion is understandable, particularly as these payments were often issued during the colder months or close to December.

However, the government clearly categorises these as Cost of Living Support and not as part of the Christmas Bonus initiative.

How Can You Check If You’ve Received the Christmas Bonus?

The DWP does not issue letters or emails to confirm Christmas Bonus payments. Instead, recipients must check their bank account statements for a transaction labelled ‘DWP XB’. This entry typically appears during the first full week of December.

Steps to verify the payment:

- Log into your online banking or review paper statements

- Look for a payment entry named ‘DWP XB’

- Confirm the amount is £10

- Check whether it was paid into the correct bank account

Because the bonus is a separate transaction, it may appear on a different day than regular benefit payments. If you believe you are eligible and do not see the bonus by mid-December, it’s advisable to contact the relevant DWP office.

What Should You Do If You Haven’t Received Your Bonus?

If you believe you’re eligible but haven’t received your £10 Christmas Bonus by the middle of December, you should take the following steps:

- First, confirm you were receiving a qualifying benefit during the qualifying week

- Check your bank statement for the transaction labelled ‘DWP XB’

- Ensure your bank details on file with the DWP are up to date

If you still haven’t received the payment, you should get in touch with the department responsible for your benefits. Use the correct point of contact based on the benefit you receive:

- State Pension recipients: Contact the Pension Service

- Other benefits: Contact your local Jobcentre Plus office

- Disability-related benefits: Contact the appropriate DWP helpline

Providing your National Insurance number, benefit claim reference, and current bank account details will help resolve the issue more efficiently.

What Are the Most Common Myths About the DWP Christmas Bonus?

Several persistent myths continue to circulate regarding the DWP Christmas Bonus, particularly around the amount, eligibility and how it is paid.

Here are the most common misunderstandings:

- The bonus is £800: False. There is no £800 DWP Christmas Bonus. The official bonus remains £10.

- Universal Credit claimants always get the bonus: Not entirely accurate. Universal Credit alone does not qualify; another eligible benefit must also be received.

- The bonus requires an application: Incorrect. The payment is automatic and does not require a separate claim.

- It is included in the normal benefit payment: Not true. It is a separate deposit and can be identified as ‘DWP XB’ in your bank account.

- It affects your tax or other benefits: No. The payment is tax-free and does not interfere with other benefit entitlements.

These myths often originate from social media, unverified news outlets, or word of mouth. Relying on official sources like GOV.UK ensures accurate and up-to-date information.

How Does the DWP Communicate Official Bonus Information?

The Department for Work and Pensions typically does not send direct notifications about the Christmas Bonus. Instead, official information is published via:

- The GOV.UK website

- Press releases from the DWP

- Public statements or guidance before the December period

The lack of direct letters or texts can lead to confusion, particularly among older claimants or those without access to digital services.

However, checking the official online channels remains the most reliable method of staying informed.

The DWP recommends checking their official communication channels before trusting information from third-party sources.

Avoid engaging with posts or messages that claim to offer “early access” or “bonus registration” opportunities, as these are not part of the legitimate process.

Is the DWP Christmas Bonus Likely to Increase in the Future?

The question of increasing the DWP Christmas Bonus has been raised many times in Parliament and public discussions.

The amount has remained £10 since its introduction in 1972, and there is currently no public indication from the DWP that this will change in 2025.

Factors affecting the bonus amount:

- Budget constraints within the Department for Work and Pensions

- Government preference to offer other financial relief through Cost of Living Payments

- The bonus being considered a symbolic gesture rather than a major support mechanism

While some advocacy groups continue to campaign for an increase to reflect modern living costs, no official announcements have been made to suggest this will happen in the near term.

Conclusion

While the DWP Christmas Bonus remains a modest £10, confusion around an £800 payment has led to widespread misinformation. These larger figures often relate to separate Cost of Living support, not the traditional bonus.

To avoid misunderstandings, it’s essential to rely on official sources like GOV.UK for accurate benefit information.

Eligible claimants will receive the Christmas Bonus automatically, with no need to apply. Staying informed ensures you know what support is available and what’s simply a rumour.

FAQs About the DWP Christmas Bonus

Does Universal Credit qualify me for the Christmas Bonus?

Universal Credit on its own does not qualify. However, if you’re receiving another qualifying benefit alongside Universal Credit, you may be eligible.

What does ‘DWP XB’ stand for on my bank statement?

‘DWP XB’ refers to the Department for Work and Pensions Christmas Bonus. It will appear this way to distinguish it from regular benefit payments.

Is the Christmas Bonus a one-time payment or recurring?

It is a one-off annual payment, made during the first full week of December to eligible individuals.

Can I receive the bonus if I live abroad?

Only if you’re ordinarily resident in the UK, Channel Islands, Isle of Man or Gibraltar. Living abroad outside these areas generally disqualifies you.

Is there an application form to receive the Christmas Bonus?

No, there is no application process. The payment is made automatically if you qualify.

Can both partners in a couple receive the bonus?

Yes, if both partners are eligible individually based on the benefits they receive, they can each receive £10.

Will the bonus affect my other benefits or tax status?

No. The bonus is tax-free and has no impact on any other benefits or entitlements.