List Price of Car for P11D: What It Includes and Why It Matters?

Understanding the list price of a car for P11D is vital for businesses and employees using company cars in the UK.

The P11D value directly influences the amount of company car tax owed by the employee and reported by the employer.

Despite its technical nature, the concept has financial implications that extend well beyond a vehicle’s showroom value.

This guide breaks down what constitutes a P11D value, how it’s calculated, and why it plays such a central role in company car taxation.

What Is the P11D Value and How Is It Different from the P11D Form?

The P11D value refers specifically to the valuation of a company car used to calculate the tax owed by an employee receiving it as a benefit.

This figure is assessed by HMRC and used to determine the Benefit in Kind (BiK) liability for the individual. While both the P11D value and the P11D form are connected, they are not the same.

The P11D form is a document submitted by employers to HMRC every year. It includes all benefits and expenses provided to directors and employees, such as medical insurance, interest-free loans, and company vehicles. The car’s P11D value is just one item listed within this form.

A common misconception is that the P11D form details the price of the car itself, but it is actually a broader document used for multiple types of employee benefits.

In contrast, the P11D value focuses exclusively on the taxable worth of the company car based on specific inclusions set by HMRC.

What Does the List Price of a Car Include for P11D Purposes?

The list price used to determine a vehicle’s P11D value is more comprehensive than a typical transaction price.

It comprises multiple cost elements that are considered taxable for the purposes of calculating BiK tax.

Included in the P11D list price:

- Manufacturer’s recommended retail price (RRP) at first registration

- Value Added Tax (VAT)

- Delivery charges

- Factory-fitted optional extras such as upgraded wheels or leather interiors

Not included in the P11D list price:

- First year’s road tax

- Vehicle registration fees

- Any discounts, dealer incentives, or special offers

This distinction is important because the list price for P11D purposes often exceeds what the company actually paid for the vehicle.

Below is a comparison of how P11D value differs from the road price typically advertised to consumers.

Comparison Between P11D Value and Road Price

| Cost Element | Included in P11D Value | Included in Road Price |

| Manufacturer’s list price | Yes | Yes |

| VAT | Yes | Yes |

| Delivery charges | Yes | Yes |

| Factory-fitted options | Yes | Sometimes |

| First registration fee | No | Yes |

| Annual road tax | No | Yes |

| Dealer discounts | No | Reflected in final price |

The table illustrates how the P11D value is more of a theoretical or standardised price point, while the road price reflects actual costs incurred by the buyer.

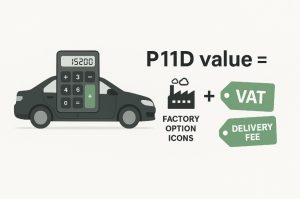

How Do You Calculate the P11D Value of a Car?

Calculating a car’s P11D value requires adding together specific cost elements associated with the vehicle, excluding fees or charges that are not taxable under HMRC rules.

The basic formula is:

P11D Value = List Price (RRP) + VAT + Delivery Fees + Factory Options

Any costs related to road tax or vehicle registration are not considered part of the P11D value, nor are dealership-specific reductions in price.

Example 1: Mid-range company car

- Manufacturer’s list price (incl. VAT): £14,700

- Delivery charge: £650

- Optional extras: None

- Road tax: £145

- Registration fee: £55

Calculated P11D Value = £14,700 + £650 = £15,350

Road Price (inc. everything) = £15,350 + £145 + £55 = £15,550

Example 2: Executive vehicle with upgrades

- Manufacturer’s list price (incl. VAT): £32,000

- Optional extras (upgraded paint, alloy wheels): £3,000

- Delivery charge: £700

Calculated P11D Value = £32,000 + £3,000 + £700 = £35,700

Even though the company may have received a fleet discount or promotional deal, HMRC does not take those savings into account when determining the P11D value.

Why Is the P11D Value Important for Company Car Tax?

The primary reason the P11D value is so significant is its role in determining how much tax the employee must pay for using a company car privately. This is calculated using the Benefit in Kind (BiK) system.

The steps are as follows:

- Multiply the P11D value by the applicable CO2 emissions-based percentage, which determines the BiK amount.

- Multiply the BiK amount by the employee’s income tax rate.

The outcome is the annual company car tax payable by the employee.

The BiK percentage is based on CO2 emissions and is adjusted each tax year. Hybrid and electric cars with low emissions benefit from lower rates, while high-emission petrol or diesel vehicles attract higher rates.

Company Car Tax Calculation Examples

| Vehicle Details | P11D Value | CO2 Emissions | BiK % | Income Tax Rate | Annual Tax Due |

| Hatchback (84g/km CO2) | £15,350 | 84 g/km | 21% | 20% | £644.70 |

| Executive saloon (154g/km CO2) | £35,000 | 154 g/km | 35% | 40% | £4,900.00 |

| Electric car (0g/km CO2) | £28,000 | 0 g/km | 2% | 20% | £112.00 |

These examples illustrate how significantly emissions and income tax rate can impact the final company car tax bill.

What Are the Key Factors That Influence Company Car Tax Rates?

Several variables determine the tax that an employee must pay on a company car. While the P11D value is the base figure used in calculations, other factors play a critical role in determining the final amount.

Key influencing factors include:

- CO2 emissions rating: The lower the emissions, the lower the BiK rate.

- Fuel type: Diesel vehicles may attract higher rates unless they meet RDE2 standards, while electric vehicles qualify for the lowest BiK percentages.

- Vehicle age and registration date: These can affect which CO2 calculation method applies.

- Income tax band: Employees in the basic (20%), higher (40%) or additional (45%) tax bands will pay increasingly more for the same BiK value.

Understanding these variables helps both employers and employees make informed decisions when choosing a vehicle for business use.

How Can You Reduce Your Company Car Tax Liability?

Reducing your company car tax liability involves strategic choices around the type of vehicle selected, how it’s configured, and an understanding of how tax is calculated by HMRC. Since company car tax is based on the P11D value, CO2 emissions, and your income tax rate, minimising any one of these factors can help lower the overall tax burden.

1. Choose Vehicles With Low CO2 Emissions

The BiK percentage applied to the P11D value is directly influenced by the vehicle’s CO2 emissions. HMRC categorises vehicles into different tax bands, with higher emissions leading to higher BiK rates.

Choosing a vehicle with emissions below 75g/km can result in a much lower BiK rate. Ultra-low emission vehicles (ULEVs), hybrids, and plug-in hybrids often fall within this favourable range.

For example:

- A petrol vehicle emitting 160g/km may attract a 37% BiK rate.

- A plug-in hybrid emitting 50g/km may only attract a 13% BiK rate.

Over a three-year lease or ownership period, this difference can amount to thousands of pounds in tax savings.

2. Opt for Fully Electric Vehicles (EVs)

Electric vehicles offer the lowest BiK tax rates, with HMRC setting the rate at 2% for the current and upcoming tax years.

This makes EVs a highly efficient option from a taxation perspective, especially when compared to diesel or petrol vehicles.

EVs are also exempt from additional surcharges such as the diesel supplement, and they often benefit from local incentives and reduced running costs.

3. Minimise Optional Extras and Factory Add-Ons

Factory-fitted optional extras increase the P11D value. While these additions may improve the comfort or prestige of the vehicle, they also directly raise the taxable benefit.

For instance, adding a panoramic sunroof, upgraded infotainment system, or premium alloy wheels could add several thousand pounds to the list price, which would then be factored into the P11D value.

To reduce tax:

- Select standard equipment packages where possible

- Avoid high-cost cosmetic or luxury upgrades

- Review the necessity of non-essential add-ons

4. Select Lower Trim Levels

Vehicles often come in different trims or spec levels. Choosing a base or mid-level trim instead of a high-end one can substantially reduce the P11D value.

Example:

- A base model might have a list price of £26,000

- A top trim version could cost £33,000

- The £7,000 difference increases the BiK calculation and, therefore, your tax liability

Employers procuring vehicles for staff can also implement policies that cap the allowable P11D value or CO2 emissions of fleet cars, helping standardise cost and compliance across the organisation.

5. Consider Salary Sacrifice Schemes for EVs

Electric cars under a salary sacrifice arrangement can be highly tax-efficient. Since BiK on EVs is extremely low, employees benefit from driving a car with minimal tax deductions while employers benefit from Class 1A NIC savings.

Salary sacrifice works best when:

- The employee is in a mid-to-high tax bracket

- The vehicle selected is fully electric with a low P11D value

- The scheme is well structured to comply with HMRC rules

What Is the Difference Between Manufacturer’s List Price and Market Price?

Understanding the difference between the manufacturer’s list price and the market price of a vehicle is critical, especially when dealing with P11D valuations. Although they might seem similar at first glance, the two serve different purposes and are calculated differently.

Manufacturer’s List Price (Used for P11D)

This is the official price set by the vehicle manufacturer at the time the car is first registered. It includes:

- The vehicle’s basic cost

- Value Added Tax (VAT)

- Standard delivery charges to the dealership

- The cost of any factory-fitted optional extras chosen before registration

The manufacturer’s list price is static and does not change based on market conditions, discounts, or how much the buyer actually pays.

HMRC mandates this figure as the base for calculating the car’s taxable benefit, ensuring consistency across all tax assessments.

Even if a business or individual purchases a car through a special promotion or fleet discount scheme, the P11D value remains the same as if the full manufacturer price was paid.

Market Price (Paid by Consumer or Business)

The market price, or “on-the-road” price, is what the buyer actually pays to take ownership of the vehicle. It includes:

- The manufacturer’s list price

- VAT and delivery fees

- Road tax and first registration fee

- Any dealer-specific discounts, cashback offers, or promotions

This is the figure most visible to consumers in advertisements or price comparison sites, and it fluctuates based on:

- Market demand

- Time of year

- Stock availability

- Negotiation with the dealership

For example, a car with a manufacturer’s list price of £32,000 may be available to a business customer for £28,000 due to a special deal.

However, for P11D purposes, HMRC still assesses it as £32,000, plus the cost of any applicable factory extras.

Why the Distinction Matters?

The use of the manufacturer’s list price for tax purposes standardises BiK calculations across all UK employers and employees, regardless of purchasing power or negotiation ability. This helps prevent tax avoidance through heavily discounted vehicle purchases.

Key points to note:

- Manufacturer’s list price is used for tax, not what you pay

- Market price reflects commercial realities, but is irrelevant to HMRC

- Discounts and incentives do not reduce P11D value

This means that two employees driving the same car, one through a fleet discount and another through retail purchase, will face identical company car tax liabilities, as the P11D value is unaffected by the price paid.

How Can Employers and Employees Report P11D Values Correctly?

Accurate reporting of P11D values is essential to maintain compliance with HMRC regulations. Errors or omissions can lead to underpayment of tax and potential penalties.

Best practices for employers:

- Maintain a record of each vehicle’s original list price and any factory options added at the time of registration

- Verify delivery charges and VAT have been included

- Ensure that discounts and on-the-road costs are excluded

- Use HMRC’s P11D working sheets or digital tools to calculate values accurately

Employees should be aware of the implications of their company car’s P11D value and should request full breakdowns from their employer if they need to check the accuracy of the declared amount.

Conclusion

The list price of a car for P11D is more than just a number—it directly impacts the Benefit in Kind tax employees must pay. From VAT and delivery charges to factory-fitted options, every component matters.

Misunderstanding what’s included or excluded could lead to incorrect tax reporting.

By understanding how the P11D value is calculated and its role in company car taxation, both employers and employees can make informed decisions and stay compliant with HMRC regulations.

Frequently Asked Questions About List Price of Car for P11D

What’s the difference between a car’s P11D value and its retail price?

The retail price reflects the amount paid by the buyer, often including discounts, whereas the P11D value is based on the full manufacturer’s list price with VAT and delivery but without discounts.

Are used cars subject to P11D value calculations?

Yes. Even used cars provided as company vehicles are taxed using the original list price, not the second-hand value.

How does the CO2 emission rating affect my company car tax?

The higher the CO2 emissions, the higher the BiK rate applied to the P11D value, resulting in greater tax liability.

Do electric cars have a different P11D value?

No, the P11D value is calculated the same way. However, electric cars benefit from a lower BiK percentage, making them more tax-efficient.

Can employers include dealer discounts when calculating P11D?

No. HMRC specifically states that the P11D value must reflect the list price before discounts are applied.

Is insurance included in the P11D value?

No. Insurance, maintenance, and fuel are not part of the P11D value, though they may be separately reportable benefits.

When must P11D values be reported to HMRC?

Employers must submit P11D forms by 6 July following the end of the tax year (5 April), along with payment of any Class 1A NIC due by 22 July.